529 Plan Money Management: Education Savings Account Financial Guide

Imagine a future where your child's education is secure, not just a dream, but a tangible plan built with smart savings and strategic investments. Navigating the world of education savings can feel daunting, but understanding the ins and outs of a 529 plan can pave the way for a brighter future for your loved ones. Are you ready to unlock the potential of 529 plans and take control of your child's educational journey?

The process of saving for college can feel like navigating a maze, filled with confusing jargon and complex choices. Families often struggle with knowing where to start, how much to save, and what investment options are best suited for their needs. Without clear guidance, the dream of higher education can feel increasingly out of reach.

This guide is your roadmap to understanding and maximizing the benefits of a 529 plan, specifically designed to help you confidently manage your education savings account. We'll break down the key concepts, explore investment strategies, and provide practical tips to help you make informed decisions that align with your financial goals. Our goal is to empower you to take control of your child's future education expenses. This guide is for parents, guardians, and anyone looking to invest in the future of a child's education through a 529 plan.

In this comprehensive guide, we've explored the key aspects of 529 plans, from understanding their benefits and investment options to developing a personalized savings strategy. By demystifying the complexities and providing practical advice, we aim to empower you to make informed decisions and confidently navigate the world of education savings. Key topics covered include the mechanics of 529 plans, investment strategies, contribution limits, tax advantages, and withdrawal rules. We also delved into the history and myths surrounding 529 plans, as well as hidden secrets and recommendations to maximize their benefits. Furthermore, we answered frequently asked questions and provided fun facts to enhance your understanding. Ultimately, our goal is to help you secure a brighter future for your loved ones by making education accessible and affordable.

Understanding 529 Plans: A Deep Dive

My journey with 529 plans began when my niece was born. I wanted to contribute to her future, and a 529 plan seemed like the perfect vehicle. However, I quickly realized that understanding the nuances of these plans was not as straightforward as I initially thought. There were different types of plans, various investment options, and a whole host of rules and regulations. I felt overwhelmed and unsure of where to start. After countless hours of research, consultations with financial advisors, and careful consideration of my niece's potential educational path, I finally felt confident in choosing a plan that aligned with her long-term goals. The key takeaway from my experience was the importance of taking the time to thoroughly understand the intricacies of 529 plans before making any investment decisions.

A 529 plan, officially known as a qualified tuition program (QTP), is a tax-advantaged savings plan designed to encourage saving for future education expenses. These plans are typically sponsored by states, state agencies, or educational institutions, and they come in two main types: prepaid tuition plans and education savings plans. Prepaid tuition plans allow you to purchase tuition credits at today's prices for use at participating colleges and universities in the future. Education savings plans, on the other hand, are investment accounts that allow you to save and invest for future education expenses. The money in the account grows tax-deferred, and withdrawals are tax-free as long as they are used for qualified education expenses. These expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. 529 plans offer several benefits, including tax advantages, flexibility, and the ability to contribute significant amounts. They are a valuable tool for families looking to save for college, vocational school, or even K-12 tuition in some cases.

History and Myths of 529 Plans

The history of 529 plans dates back to 1996 when Congress created them as part of the Small Business Job Protection Act. Initially, they were primarily designed to help families save for college expenses. However, over the years, Congress has expanded the scope of 529 plans to include a wider range of educational expenses, such as K-12 tuition and apprenticeship programs. This evolution reflects the changing landscape of education and the growing need for flexible savings options. One common myth surrounding 529 plans is that they are only for wealthy families. In reality, 529 plans are accessible to families of all income levels. The tax advantages and flexible contribution options make them a valuable tool for anyone looking to save for future education expenses. Another myth is that 529 plans are only beneficial if your child attends an in-state college. While some states offer additional tax benefits for residents who invest in their own state's 529 plan, these plans can be used at any eligible educational institution nationwide.

Another myth is that the money in a 529 plan will be lost if the beneficiary doesn't go to college. This is not true. The beneficiary can be changed to another family member, or the funds can be used for other qualified education expenses. In some cases, non-qualified withdrawals are possible, although they may be subject to taxes and penalties. Understanding the history and dispelling the myths surrounding 529 plans can help families make informed decisions and confidently plan for their children's educational future.

Hidden Secrets of 529 Plans

One of the best-kept secrets of 529 plans is their estate planning benefits. Contributions to a 529 plan are considered completed gifts, which means they are removed from your taxable estate. This can be a valuable tool for reducing estate taxes, especially for high-net-worth individuals. Another hidden secret is the ability to front-load contributions. While there are annual contribution limits, you can make a lump-sum contribution of up to five times the annual limit in a single year, as long as you elect to treat it as if it were made over a five-year period. This can be a great way to maximize your savings potential and take advantage of the tax benefits early on. Furthermore, many states offer additional tax deductions or credits for contributions to their 529 plans. These state tax benefits can significantly boost your overall savings and make 529 plans even more attractive. It's essential to research the specific rules and regulations in your state to take full advantage of these benefits. Another lesser-known aspect of 529 plans is the ability to use them for qualified apprenticeship programs. This can be a valuable option for individuals who choose to pursue vocational training or skilled trades instead of traditional college.

Recommendations for 529 Plans

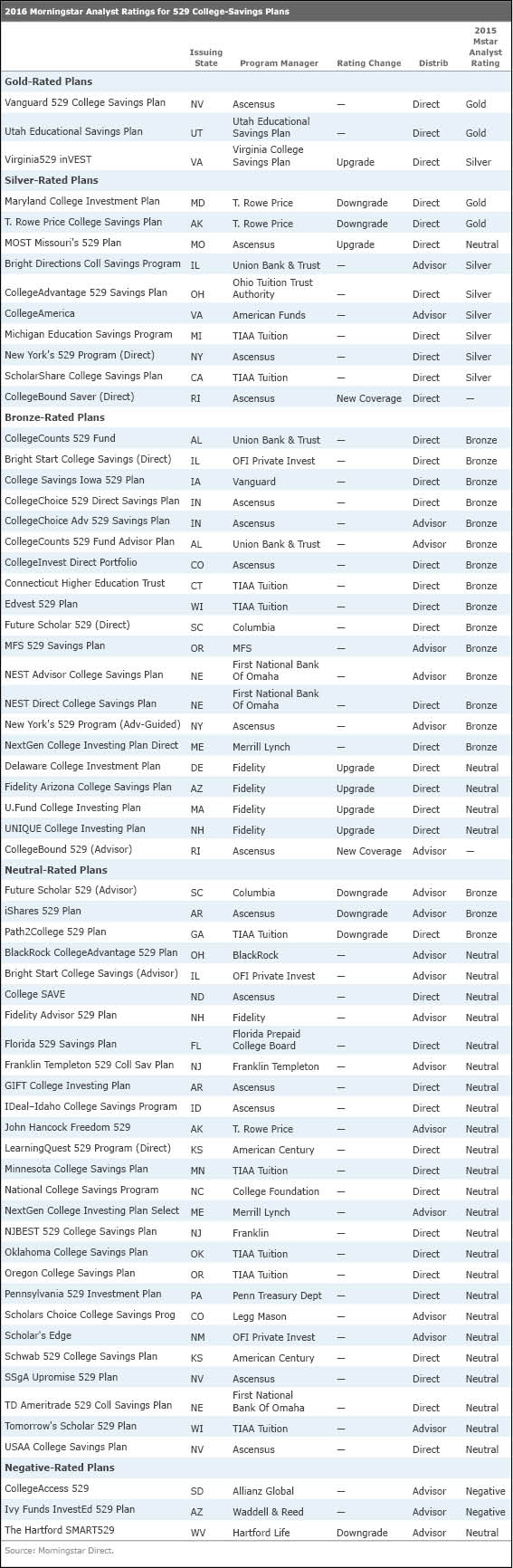

Before you start, research your state's 529 plan and compare it with other plans available nationwide. Consider factors such as investment options, fees, and state tax benefits. Don't be afraid to shop around and choose the plan that best fits your needs. Develop a savings strategy. Determine how much you can realistically contribute each month or year, and set a goal for the total amount you want to save. Consider automating your contributions to make saving easier and more consistent. Diversify your investments. Spread your contributions across different asset classes to reduce risk and maximize potential returns. Choose a mix of stocks, bonds, and other investments that aligns with your risk tolerance and time horizon. Review and rebalance your portfolio periodically to ensure it stays on track with your goals. Take advantage of tax benefits. Maximize your contributions to take advantage of any state tax deductions or credits. Understand the rules for qualified withdrawals to avoid paying taxes and penalties. Start early. The earlier you start saving, the more time your money has to grow. Even small contributions can make a big difference over time. Consider opening a 529 plan as soon as your child is born to take advantage of the power of compounding. Seek professional advice. If you're unsure about any aspect of 529 plans, consult with a financial advisor. They can help you assess your financial situation, develop a savings strategy, and choose the right investment options.

Understanding Contribution Limits and Tax Advantages

Contribution limits for 529 plans vary by state, but they are generally quite generous. Many states allow total contributions of over $300,000 per beneficiary. While there are no annual contribution limits per se, contributions exceeding the annual gift tax exclusion amount (currently $17,000 per individual) may require filing a gift tax return. However, you can elect to treat a lump-sum contribution of up to five times the annual limit as if it were made over a five-year period, which can help you avoid gift tax issues. One of the most significant advantages of 529 plans is their tax benefits. Contributions are not tax-deductible at the federal level, but many states offer a deduction or credit for contributions to their own state's 529 plan. The earnings in the account grow tax-deferred, and withdrawals are tax-free as long as they are used for qualified education expenses. This tax-free growth can significantly boost your savings over time. Qualified education expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. In recent years, the definition of qualified education expenses has been expanded to include K-12 tuition (up to $10,000 per year) and qualified apprenticeship programs.

Tips for Maximizing Your 529 Plan

Start early to take advantage of compounding returns. Even small amounts invested early can grow significantly over time. Automate contributions to ensure consistent saving. Set up automatic transfers from your bank account to your 529 plan to make saving easier and more convenient. Choose age-based investment options. These options automatically adjust the asset allocation over time, becoming more conservative as the beneficiary gets closer to college age. Rebalance your portfolio regularly. Periodically review your investment allocation and rebalance as needed to maintain your desired risk level. Consider gifting to the 529 plan. Ask family and friends to contribute to the 529 plan instead of giving traditional gifts for birthdays and holidays. Shop around for the best plan. Compare fees, investment options, and state tax benefits before choosing a 529 plan. Check for state tax benefits. Many states offer a deduction or credit for contributions to their own state's 529 plan. Be mindful of the gift tax rules. Contributions exceeding the annual gift tax exclusion amount may require filing a gift tax return. Understand qualified expenses. Make sure you're only using withdrawals for qualified education expenses to avoid taxes and penalties. Don't be afraid to change beneficiaries. If the original beneficiary doesn't go to college, you can change the beneficiary to another family member. Use a 529 plan for K-12 tuition. You can use up to $10,000 per year from a 529 plan for K-12 tuition expenses.

Understanding Qualified Withdrawals

Qualified withdrawals from a 529 plan are those used for eligible educational expenses, and they are tax-free at both the federal and state levels. This is one of the primary benefits of using a 529 plan for education savings. Eligible educational expenses typically include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. An eligible educational institution is generally defined as any college, university, vocational school, or other post-secondary educational institution that is eligible to participate in federal student aid programs. In recent years, the definition of qualified withdrawals has been expanded to include expenses for registered apprenticeship programs and K-12 tuition (up to $10,000 per year per beneficiary). It's important to keep detailed records of all educational expenses to ensure that your withdrawals qualify for tax-free treatment. If you use 529 plan funds for non-qualified expenses, the earnings portion of the withdrawal will be subject to income tax and a 10% penalty. To avoid these penalties, it's crucial to understand the rules and regulations surrounding qualified withdrawals.

Fun Facts About 529 Plans

Did you know that 529 plans are named after Section 529 of the Internal Revenue Code, which created them in 1996? The first 529 plans were designed to help families save for college expenses, but their scope has expanded over the years to include K-12 tuition and apprenticeship programs. The average 529 plan account balance is around $25,000, but some accounts can hold hundreds of thousands of dollars. 529 plans are not just for parents; grandparents, other relatives, and even friends can contribute to a child's 529 plan. You can have multiple 529 plans for the same beneficiary, but it's generally recommended to consolidate your savings into a single plan for easier management. Some states offer "scholarship" 529 plans, which allow you to save for college while also supporting a scholarship program. 529 plans can be used at any eligible educational institution nationwide, not just in your state. The tax benefits of 529 plans can save you thousands of dollars over the long term. 529 plans are a powerful tool for making education accessible and affordable for everyone.

How to Open a 529 Plan

Opening a 529 plan is a relatively straightforward process. The first step is to research and compare different 529 plans offered by your state and other states. Consider factors such as investment options, fees, and state tax benefits. Once you've chosen a plan, you'll need to gather some basic information, including the beneficiary's name, date of birth, and Social Security number. You'll also need to provide your own information, such as your name, address, and Social Security number. Most 529 plans allow you to open an account online. You'll need to complete an application, choose your investment options, and make an initial contribution. Some plans may require a minimum initial contribution, while others may allow you to start with as little as $25. Once your account is open, you can start making regular contributions. Many plans allow you to set up automatic contributions from your bank account to make saving easier and more consistent. It's important to review your account statements regularly and monitor your investment performance. You may also want to rebalance your portfolio periodically to ensure it stays on track with your goals. If you have any questions or need assistance, most 529 plans offer customer support through phone, email, or online chat.

What if the Beneficiary Doesn't Go to College?

One of the most common concerns about 529 plans is what happens if the beneficiary doesn't go to college or doesn't use all of the funds in the account. Fortunately, there are several options available in this scenario. The most straightforward option is to change the beneficiary to another family member. This could be a sibling, cousin, niece, nephew, or even yourself. As long as the new beneficiary is a member of the original beneficiary's family, the funds can be used for their qualified education expenses without incurring any penalties. Another option is to use the funds for other qualified education expenses. This could include graduate school, vocational school, or even K-12 tuition (up to $10,000 per year). In some cases, you may be able to take a non-qualified withdrawal. However, the earnings portion of the withdrawal will be subject to income tax and a 10% penalty. There are a few exceptions to the penalty, such as if the beneficiary becomes disabled or dies. If you're unsure about the best course of action, it's always a good idea to consult with a financial advisor. They can help you assess your situation and make the best decision for your individual needs.

Listicle of 529 Plan Benefits

Tax-advantaged growth: Earnings grow tax-deferred, and withdrawals are tax-free for qualified education expenses. Flexibility: Funds can be used at any eligible educational institution nationwide. Control: You maintain control of the account, even after the beneficiary reaches adulthood. Gifting opportunities: Friends and family can contribute to the plan. Estate planning benefits: Contributions are considered completed gifts and are removed from your taxable estate. High contribution limits: Many states allow total contributions of over $300,000 per beneficiary. State tax benefits: Many states offer a deduction or credit for contributions to their own state's 529 plan. Wide range of investment options: Choose from a variety of investment options to suit your risk tolerance and time horizon. Can be used for K-12 tuition: Up to $10,000 per year can be used for K-12 tuition expenses. Can be used for apprenticeship programs: Funds can be used for qualified apprenticeship programs. Ability to change beneficiaries: If the original beneficiary doesn't go to college, you can change the beneficiary to another family member. Professional management: Some plans offer professionally managed investment options. Easy to open and manage: Opening and managing a 529 plan is typically a straightforward process. Peace of mind: Knowing that you're saving for your child's future education can provide peace of mind.

Question and Answer

Q: What are the two main types of 529 plans?

A: The two main types of 529 plans are prepaid tuition plans and education savings plans. Prepaid tuition plans allow you to purchase tuition credits at today's prices for use at participating colleges and universities in the future. Education savings plans are investment accounts that allow you to save and invest for future education expenses.

Q: What are qualified education expenses?

A: Qualified education expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution. In recent years, the definition has been expanded to include K-12 tuition (up to $10,000 per year) and qualified apprenticeship programs.

Q: What happens if the beneficiary doesn't go to college?

A: If the beneficiary doesn't go to college, you can change the beneficiary to another family member, use the funds for other qualified education expenses, or take a non-qualified withdrawal (subject to taxes and penalties).

Q: Are contributions to a 529 plan tax-deductible?

A: Contributions to a 529 plan are not tax-deductible at the federal level, but many states offer a deduction or credit for contributions to their own state's 529 plan.

Conclusion of 529 Plan Money Management: Education Savings Account Financial Guide

Investing in a 529 plan is one of the smartest moves you can make for your child's future. By understanding the ins and outs of these plans, and taking advantage of their many benefits, you can provide your children with a head start in life and give them the opportunity to pursue their dreams without being burdened by debt. Take the time to research, compare, and choose a 529 plan that fits your needs, and start saving today. The future of your children is worth it.

Post a Comment