Administrator Money Management: Management Professional Budget

Ever feel like your paycheck vanishes the moment it hits your bank account? You’re not alone. For many management professionals, especially administrators juggling countless responsibilities, mastering personal finances can feel like climbing a never-ending mountain. Let's explore how to conquer that financial peak and build a budget that truly works for you.

Many administrative professionals face unique challenges when it comes to managing their money. Irregular hours, fluctuating workloads, and the constant pressure to maintain a professional image can all contribute to financial stress. It's easy to fall into the trap of overspending to compensate for the demands of the job, or neglecting long-term financial planning due to a lack of time and energy.

This guide is designed to help administrative professionals take control of their financial lives. We'll explore practical strategies for creating and maintaining a budget that aligns with your income, expenses, and financial goals. Whether you're looking to pay off debt, save for a down payment, or simply gain a better understanding of where your money is going, we've got you covered.

In this article, we'll delve into creating a realistic budget, tracking expenses effectively, setting financial goals, and discovering strategies to eliminate debt and boost savings. We will also touch on a brief history, fun facts, and hidden secrets related to Administrator Money Management: Management Professional Budget. By understanding these concepts, you can gain better financial control and pave the way for a more secure and prosperous future.

Understanding Your Income and Expenses

The cornerstone of any successful budget is a clear understanding of your income and expenses. I remember when I first started my administrative role, I was so focused on excelling at my job that I completely neglected to track my spending. At the end of each month, I would be surprised and frustrated by how little I had left, and I had no clue where it had all gone. One day I took the challenge to track every single penny I spent. It was eye-opening. I realized I was spending far too much on eating out and impulse purchases.

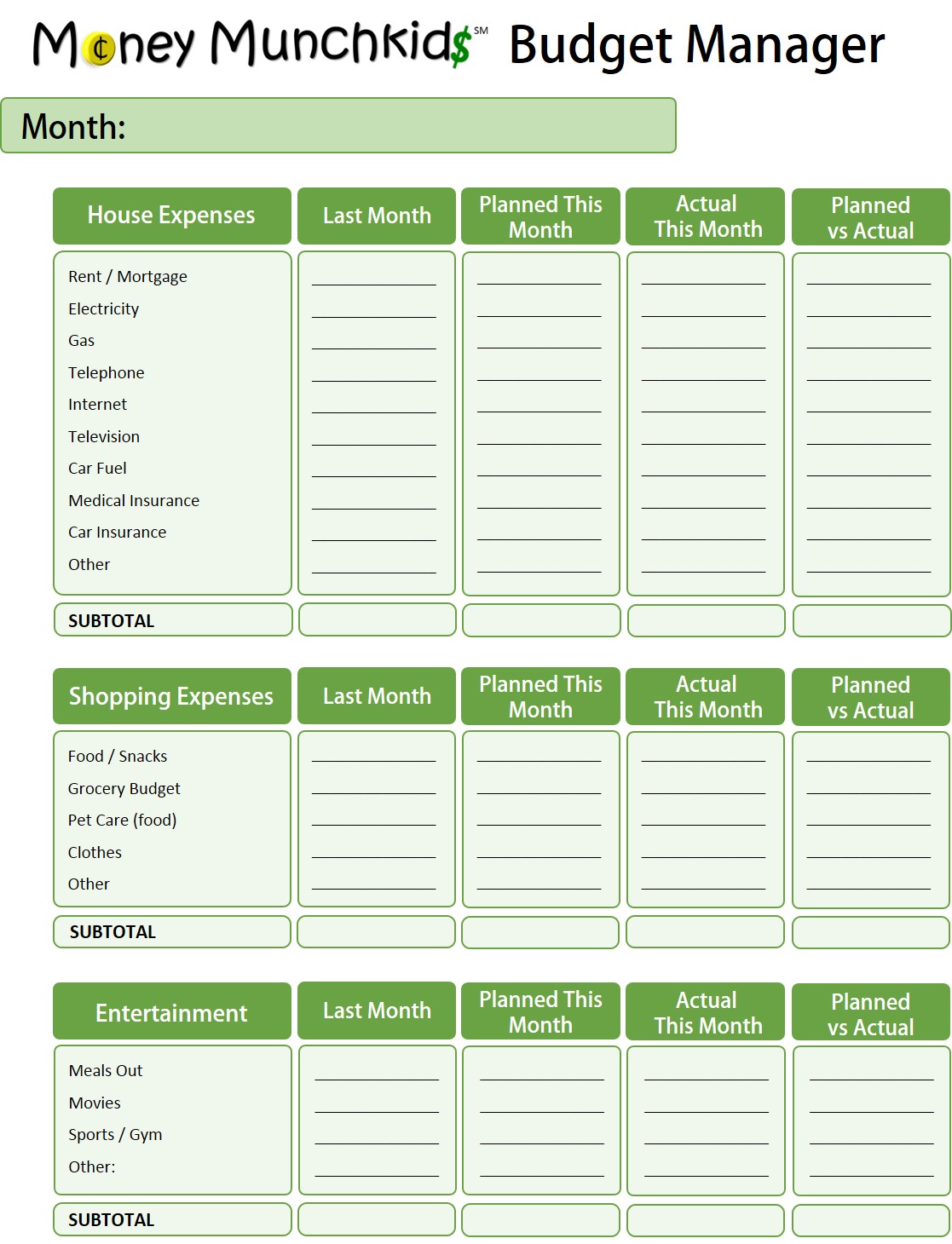

Administrator Money Management requires a clear picture of the money coming in and going out. Start by calculating your net monthly income (your income after taxes and deductions). Then, track your expenses for a month or two. You can use a budgeting app, a spreadsheet, or even a simple notebook. Be sure to categorize your expenses into fixed costs (rent, mortgage, car payments) and variable costs (groceries, utilities, entertainment). This process is crucial to understanding Administrator Money Management: Management Professional Budget. Once you have a clear overview, you can identify areas where you can cut back and redirect those funds towards your financial goals.

Creating a Realistic Budget

A realistic budget isn't about deprivation; it's about making conscious choices about how you spend your money. It's a plan that aligns your spending with your values and goals. Administrator Money Management: Management Professional Budget is not only about saving, but understanding your needs. You need to create a spreadsheet or you can also use a budgeting app to help plan for your expenses and savings.

The 50/30/20 rule is a simple and effective budgeting method. It suggests allocating 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment. Feel free to adjust these percentages to suit your individual circumstances. The goal is to create a sustainable budget that you can stick to over the long term.

Administrator Money Management will help you allocate how much you are planning to spend each month. Keep in mind, it can be very hard at first, but will be worth it in the long run.

The History and Myth of Budgeting

Budgeting has been around for centuries, although its forms and purposes have evolved significantly over time. Administrator Money Management: Management Professional Budget began as a tool for governments and large organizations to manage their resources. While we cannot be certain about it, we can say that, one thing that makes the budget a need, is because the government and large organizations need to track their money.

One common myth about budgeting is that it's restrictive and takes all the fun out of life. While it's true that budgeting requires discipline, it doesn't mean you can't enjoy yourself. A well-designed budget should include room for discretionary spending, allowing you to indulge in your hobbies and interests without feeling guilty. It's about finding a balance between enjoying the present and planning for the future.

Administrator Money Management can be a life changer. It doesn't mean you have to lose all the fun, it just means you have to be more cautious and aware of your money.

The Hidden Secrets of a Successful Budget

One of the biggest secrets to successful budgeting is automation. Set up automatic transfers from your checking account to your savings account each month. This "pay yourself first" approach ensures that you're consistently saving towards your goals. Administrator Money Management ensures that you are saving and not spending too much. It's crucial to focus on the savings portion, or you'll end up not having any money when you actually need it.

Another secret is to regularly review and adjust your budget. Life changes – you might get a raise, change jobs, or experience unexpected expenses. Make sure your budget reflects your current circumstances. Consistency and flexibility are the keys to making a budget work for you in the long run.

Administrator Money Management makes sure you are flexible. It's okay to make adjustment if life happens, and the key is to just keep going!

Recommended Budgeting Strategies

There are numerous budgeting strategies available, each with its own strengths and weaknesses. The best strategy for you will depend on your personality, income level, and financial goals. Administrator Money Management will help you find the right fit for your situation. If you have high debt, consider the debt snowball or debt avalanche method. If you want a simple and straightforward approach, the 50/30/20 rule might be a good fit. The key is to experiment and find what works best for you.

One popular strategy is the envelope system, where you allocate cash for specific spending categories and physically put the money in envelopes. This can be particularly effective for controlling variable expenses like groceries and entertainment. Administrator Money Management comes up with these ideas to ensure that you are able to control your money.

Tracking Your Progress

Tracking your progress is essential for staying motivated and making informed financial decisions. Monitor your spending regularly to identify any areas where you're going over budget. Administrator Money Management helps you stay within your limits. Use a budgeting app or spreadsheet to track your income, expenses, and savings progress. Celebrating small wins along the way can help you stay on track and reinforce positive financial habits. The feeling of accomplishment will motivate you to continue your savings journey.

Tips for Sticking to Your Budget

Sticking to a budget can be challenging, especially at first. The key is to be patient, persistent, and flexible. Remember that it's okay to make mistakes. The important thing is to learn from them and keep moving forward. Administrator Money Management helps you remember that it is a journey to keep on trying.

One tip is to set realistic goals. Don't try to cut back too much too quickly. Start with small changes and gradually increase your savings rate over time. Another tip is to find an accountability partner – a friend, family member, or financial advisor who can support you and keep you on track. The more people you have to support you, the easier it will be to stick to your savings plan.

Automate Your Savings

Automating your savings is one of the most effective ways to build wealth. Set up automatic transfers from your checking account to your savings account each month. You can also automate your bill payments to avoid late fees and maintain a good credit score. Administrator Money Management ensures you don't have to do everything manually. Automation is one of the secrets to keeping on track and on top of all your spending.

Fun Facts About Money Management

Did you know that the average millionaire isn't a high-powered executive but a business owner or professional who lives below their means and invests wisely? Administrator Money Management is the key to wealth! It's all about the choices you make, not how much you earn. It's also interesting to note that studies have shown that people who track their spending are more likely to achieve their financial goals. Knowledge is power, and understanding where your money is going is the first step towards financial success.

How to Budget Effectively

Budgeting effectively requires a combination of planning, discipline, and flexibility. Start by setting clear financial goals. What do you want to achieve? Do you want to pay off debt, save for a down payment, or retire early? Having clear goals will help you stay motivated and make informed financial decisions.

Next, track your income and expenses. Use a budgeting app or spreadsheet to monitor your spending and identify areas where you can cut back. Administrator Money Management helps you stay on top of everything. Finally, create a realistic budget that aligns with your income, expenses, and goals. Be sure to regularly review and adjust your budget as your circumstances change. Remember, budgeting is a marathon, not a sprint.

What If You Fall Off Track?

It's important to remember that setbacks are a normal part of the financial journey. If you fall off track with your budget, don't beat yourself up about it. Just acknowledge the mistake, learn from it, and get back on track as quickly as possible. Administrator Money Management has its ups and downs. It's all about getting back on the road. The more you practice Administrator Money Management, the easier it will be.

Listicle of Administrator Money Management: Management Professional Budget

Here's a quick list to recap the essentials of effective money management for administrative professionals:

- Know your income and expenses: Track where your money comes from and where it goes.

- Set clear financial goals: Define what you want to achieve with your money.

- Create a realistic budget: Align your spending with your income and goals.

- Automate your savings: "Pay yourself first" by setting up automatic transfers.

- Track your progress: Monitor your spending and savings regularly.

- Stay flexible: Adjust your budget as your circumstances change.

- Seek support: Find an accountability partner or financial advisor to help you stay on track.

Administrator Money Management is a journey, not a destination. The more you practice it, the easier it will be.

Question and Answer

Q: How do I start budgeting when I have no idea where my money goes?

A: Start by tracking your spending for a month or two. Use a budgeting app, a spreadsheet, or even a simple notebook. Be sure to categorize your expenses into fixed and variable costs.

Q: What if I can't stick to my budget?

A: Don't be too hard on yourself. Budgeting is a skill that takes practice. Review your budget, identify areas where you're struggling, and make adjustments.

Q: How can I save money when I'm already living paycheck to paycheck?

A: Look for small ways to cut back on expenses, such as packing your lunch or brewing your own coffee. Even saving a few dollars a day can add up over time.

Q: Should I use a budgeting app or a spreadsheet?

A: It depends on your preference. Budgeting apps are convenient and can automate many tasks. Spreadsheets offer more flexibility and customization.

Conclusion of Administrator Money Management: Management Professional Budget

Mastering your finances as an administrative professional doesn't have to be overwhelming. By understanding your income and expenses, creating a realistic budget, and implementing effective savings strategies, you can take control of your financial future. Remember that it's a journey, not a destination, and that consistency and flexibility are key to long-term success. With dedication and the right tools, you can achieve your financial goals and enjoy a more secure and prosperous life.

Post a Comment