Coverdell ESA Budget Planning: Education Savings Financial Strategies

Imagine a future where your child's education is secured, not just by dreams, but by smart financial planning. That’s the promise of a Coverdell ESA, a dedicated savings tool designed to help families navigate the rising costs of education.

Many parents find themselves overwhelmed by the sheer expense of schooling, from preschool to post-secondary education. Figuring out how to set aside enough money, understand the rules surrounding educational savings, and maximize the potential of these accounts can feel like a daunting task. Juggling current expenses with future educational needs requires careful consideration and a solid plan.

This post aims to demystify the Coverdell ESA and provide you with practical strategies for effective budget planning. We'll explore how these accounts can be a powerful tool in your education savings arsenal, covering contribution limits, eligible expenses, investment options, and more. We will help you understand the Coverdell ESA’s role in securing your child's academic future.

In short, this post will guide you through the ins and outs of Coverdell ESAs, offering tips for effective budget planning, exploring contribution limits, eligible expenses, and investment options. Armed with this knowledge, you’ll be better equipped to make informed decisions and maximize the benefits of a Coverdell ESA for your child's education. The key words we'll explore are Coverdell ESA, education savings, budget planning, financial strategies, and investment options.

Understanding the Coverdell ESA

The target audience for understanding the Coverdell ESA includes parents, grandparents, and anyone else who wishes to save for a child's future educational expenses. It’s designed for individuals who want to take a proactive approach to funding education costs and want to explore different saving vehicles beyond traditional savings accounts. It also caters to those who prefer more control over their investment options within a tax-advantaged framework.

I remember when my niece was born, my sister and I were discussing how we could start saving for her education early on. The rising costs of college were already a concern, and we wanted to find a way to ease the financial burden for her parents. We explored various options, including traditional savings accounts and 529 plans. That's when we stumbled upon the Coverdell ESA. Initially, we were a bit intimidated by the details – contribution limits, eligible expenses, investment options – it all seemed quite complex. However, as we delved deeper, we realized the potential benefits. The tax-advantaged growth and the flexibility to use the funds for elementary, secondary, or post-secondary education were particularly attractive. After doing our research, we decided to open a Coverdell ESA for my niece and contribute regularly. It gave us a sense of security knowing we were actively investing in her future. The beauty of the Coverdell ESA lies in its potential for tax-free growth. Any earnings within the account are not subject to taxes, and withdrawals are tax-free as long as they are used for qualified education expenses. This can significantly boost your savings over time. Furthermore, the funds can be used for a wide range of educational expenses, including tuition, fees, books, supplies, and even room and board. This makes it a versatile tool for funding education at any level.

What is Coverdell ESA Budget Planning?

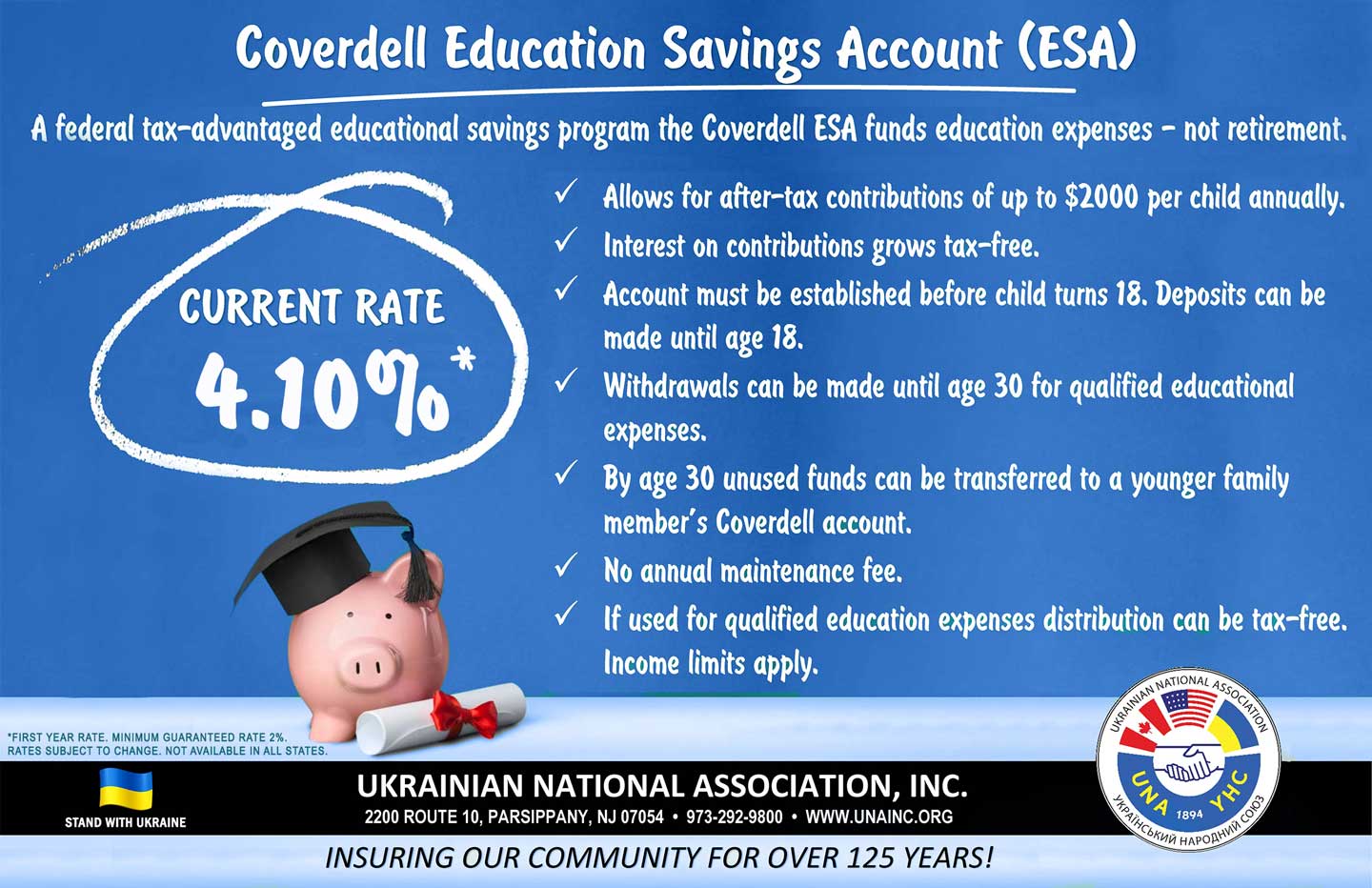

Coverdell ESA budget planning refers to creating a financial strategy that incorporates a Coverdell Education Savings Account (ESA) as a key component of funding a child's education. It involves determining how much to contribute to the ESA regularly, deciding on investment options within the account, and understanding how the ESA fits into the overall financial plan alongside other savings vehicles like 529 plans or traditional savings accounts.

Essentially, Coverdell ESA budget planning is about strategically allocating funds to maximize the benefits of this tax-advantaged savings tool. It requires careful consideration of factors such as the child's age, projected educational expenses, risk tolerance, and income eligibility. It’s not just about randomly setting aside money; it’s about having a clear, well-defined plan that aligns with your financial goals and ensures you’re making the most of the ESA's features. Budgeting for a Coverdell ESA also involves deciding how to invest the funds within the account. You have the flexibility to choose from a variety of investment options, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Your investment decisions should be based on your risk tolerance and the time horizon until the funds will be needed for education expenses. For example, if your child is young, you may opt for a more aggressive investment strategy with a higher allocation to stocks, as you have more time to ride out any market fluctuations. As your child gets closer to college age, you may want to shift to a more conservative approach with a higher allocation to bonds to protect your capital. A well-structured budget also takes into account the contribution limits of the Coverdell ESA. Currently, the maximum annual contribution is $2,000 per beneficiary, regardless of how many accounts they have. It’s important to stay within this limit to avoid any tax penalties. Finally, Coverdell ESA budget planning should be an ongoing process. Regularly review your plan, assess your progress, and make any necessary adjustments based on changes in your financial situation or the child's educational needs. By actively managing your Coverdell ESA and incorporating it into your overall financial plan, you can significantly increase your chances of achieving your education savings goals.

History and Myth of Coverdell ESA Budget Planning

The Coverdell ESA, originally known as the Education IRA, was established in 1997. It was later renamed in honor of the late Senator Paul Coverdell. The original intent was to provide a tax-advantaged way for families to save for college expenses. Over time, the rules were expanded to include K-12 expenses, making it a more versatile savings tool.

One common myth is that Coverdell ESAs are only for wealthy families. While there are income limitations, they are more generous than many people realize. The income limits are designed to help middle-income families save for education. Another myth is that Coverdell ESAs are difficult to manage. In reality, they are relatively straightforward. You can open an account at most brokerage firms and choose from a variety of investment options. Plus, the tax benefits make it worthwhile to learn the basics. The idea that Coverdell ESAs are only for college is also a misconception. Funds can be used for qualified elementary and secondary education expenses, such as tuition, books, supplies, and equipment. This makes it a valuable tool for families with children in private schools or homeschooling. A historical turning point for Coverdell ESAs was the Economic Growth and Tax Relief Reconciliation Act of 2001, which significantly increased the contribution limits and expanded the eligible expenses. This made the Coverdell ESA a more attractive option for many families. However, it's also important to remember that the contribution limit has remained at $2,000 per year since then, which hasn't kept pace with the rising costs of education. Understanding the history and dispelling the myths surrounding Coverdell ESAs can empower families to make informed decisions about their education savings strategy. By knowing the facts, you can determine if a Coverdell ESA is the right tool for your specific needs and goals.

Hidden Secrets of Coverdell ESA Budget Planning

One of the lesser-known advantages of a Coverdell ESA is the ability to transfer the account to another family member. If the original beneficiary decides not to pursue further education, or if there are remaining funds after their education is complete, you can transfer the account to another eligible family member, such as a sibling or cousin. This flexibility can be a significant benefit, as it ensures that the funds are used for educational purposes within the family.

Another hidden secret is the ability to use Coverdell ESA funds for special needs expenses. If the beneficiary has special needs, the funds can be used for a wide range of expenses related to their education and development, such as therapy, tutoring, and specialized equipment. This can be a valuable resource for families with special needs children. One often-overlooked aspect is the potential for estate planning benefits. While the contribution limits are relatively low, a Coverdell ESA can be a way to transfer assets to future generations while still maintaining some control over how the funds are used. It's important to consult with a financial advisor or estate planning attorney to understand the specific implications for your situation. Another key to maximizing the benefits of a Coverdell ESA is to start saving early. The earlier you start, the more time your investments have to grow, and the more you can take advantage of the tax-free compounding. Even small, regular contributions can make a big difference over time. A strategic approach to asset allocation is also crucial. Consider your risk tolerance and time horizon when choosing investment options within the account. As your child gets closer to college age, you may want to shift to a more conservative investment strategy to protect your capital. Finally, don't forget to keep accurate records of your contributions and expenses. This will make it easier to track your progress and ensure that you are using the funds for qualified education expenses. By uncovering these hidden secrets and implementing smart strategies, you can unlock the full potential of your Coverdell ESA and help secure your child's educational future.

Recommendation of Coverdell ESA Budget Planning

For most families, a Coverdell ESA should be considered as part of a broader education savings strategy, rather than the sole solution. It works best when combined with other savings vehicles, such as 529 plans, to maximize your overall savings potential.

I would recommend consulting with a qualified financial advisor to develop a personalized education savings plan that takes into account your specific financial situation, goals, and risk tolerance. A financial advisor can help you determine the right mix of savings vehicles, investment strategies, and contribution amounts to help you achieve your education savings goals. Consider starting early. The earlier you begin saving, the more time your investments have to grow, and the more you can benefit from the power of compounding. Even small, regular contributions can make a significant difference over time. Be mindful of the income limitations. If your income exceeds the limits, you may not be eligible to contribute to a Coverdell ESA. In that case, a 529 plan may be a better option. Diversify your investments. Don't put all your eggs in one basket. Spread your investments across a variety of asset classes to reduce risk and potentially increase returns. Regularly review your plan. As your financial situation and educational needs change, it's important to review your plan and make any necessary adjustments. Be sure to keep accurate records of your contributions and expenses. This will make it easier to track your progress and ensure that you are using the funds for qualified education expenses. Finally, don't be afraid to seek professional help. A financial advisor can provide valuable guidance and support as you navigate the complexities of education savings. By following these recommendations, you can create a solid Coverdell ESA budget planning strategy that helps you achieve your education savings goals and secure your child's future.

Maximizing Contributions and Investment Growth

To truly maximize the benefits of a Coverdell ESA, it's crucial to understand the contribution limits and optimize your investment strategy. Currently, the maximum annual contribution is $2,000 per beneficiary. While this may seem like a small amount, consistent contributions over time can add up significantly, especially when combined with tax-free growth. Consider setting up automatic contributions to ensure that you are consistently saving for your child's education. This can help you stay on track and avoid the temptation to spend the money elsewhere.

When it comes to investment growth, it's important to choose investment options that align with your risk tolerance and time horizon. If your child is young, you may want to consider a more aggressive investment strategy with a higher allocation to stocks, as you have more time to ride out any market fluctuations. As your child gets closer to college age, you may want to shift to a more conservative approach with a higher allocation to bonds to protect your capital. Don't be afraid to rebalance your portfolio periodically to ensure that it stays aligned with your goals and risk tolerance. This involves selling some of your investments that have performed well and buying more of those that have underperformed. This can help you maintain a diversified portfolio and potentially increase your returns over time. Another strategy is to consider using a low-cost, diversified mutual fund or exchange-traded fund (ETF) as the core holding in your Coverdell ESA. These funds can provide broad exposure to the stock market or bond market, and they typically have lower fees than actively managed funds. Finally, remember that patience is key when it comes to investing. Don't get discouraged by short-term market fluctuations. Focus on the long-term goals and stay committed to your investment strategy. By maximizing contributions and optimizing your investment growth, you can significantly increase the value of your Coverdell ESA and help secure your child's educational future.

Tips of Coverdell ESA Budget Planning

Effective budget planning for a Coverdell ESA involves several key strategies. First, determine your savings goals. How much do you realistically need to save to cover your child's future educational expenses? This will help you determine how much to contribute to the ESA each year.

Next, create a budget that includes regular contributions to your Coverdell ESA. Treat it as a non-negotiable expense, just like rent or utilities. Automate your contributions to make it easier to stick to your budget. Consider setting up automatic transfers from your bank account to your Coverdell ESA on a monthly or bi-weekly basis. This will help you stay on track and avoid the temptation to spend the money elsewhere. Regularly review your budget and make adjustments as needed. As your income and expenses change, you may need to adjust your contribution amount to ensure that you are still meeting your savings goals. Be mindful of the income limitations. If your income exceeds the limits, you may not be eligible to contribute to a Coverdell ESA. In that case, consider using a 529 plan instead. Don't be afraid to seek professional help. A financial advisor can provide valuable guidance and support as you develop your Coverdell ESA budget planning strategy. They can help you assess your financial situation, set realistic goals, and choose the right investment options. Remember that even small contributions can make a big difference over time. Start saving as early as possible, and be consistent with your contributions. By following these tips, you can create an effective Coverdell ESA budget planning strategy that helps you achieve your education savings goals.

Understanding Qualified Education Expenses

A crucial aspect of Coverdell ESA planning is understanding what constitutes a "qualified education expense." This determines what you can use the funds for without incurring penalties. Generally, qualified expenses include tuition, fees, books, supplies, and equipment required for enrollment or attendance at an eligible educational institution.

Eligible institutions include not only colleges and universities but also elementary and secondary schools. This means you can use the funds for private school tuition, tutoring, and other educational expenses for younger children. However, it's essential to keep detailed records of your expenses to prove that they are qualified. This can include receipts, invoices, and other documentation. Be aware that room and board expenses are also considered qualified, but only up to the cost of attendance at the educational institution. This means that if your child lives off-campus, you can only use the funds to cover their room and board expenses up to the amount that the school estimates it would cost for them to live on campus. Also, remember that the funds must be used for the benefit of the beneficiary. You cannot use the funds to pay for expenses that are not directly related to their education. If you are unsure whether an expense qualifies, consult with a tax professional or review the IRS guidelines for Coverdell ESAs. By understanding what constitutes a qualified education expense, you can ensure that you are using your Coverdell ESA funds wisely and avoiding any penalties. This will help you maximize the benefits of this valuable education savings tool.

Fun Facts of Coverdell ESA Budget Planning

Did you know that the Coverdell ESA was originally called the Education IRA? It was later renamed in honor of Senator Paul Coverdell, a strong advocate for education savings. The name change highlights the importance of this savings vehicle in helping families fund their children's education.

Another fun fact is that you can contribute to both a Coverdell ESA and a 529 plan for the same beneficiary in the same year. This allows you to maximize your education savings potential. However, it's important to be aware of the contribution limits for each account. One often-overlooked fact is that Coverdell ESA funds can be used for special needs expenses. This can be a valuable resource for families with special needs children. The flexibility of the Coverdell ESA is also a fun fact. You can use the funds for a wide range of educational expenses, including tuition, fees, books, supplies, and even room and board. This makes it a versatile tool for funding education at any level. Another interesting fact is that you can transfer the account to another family member if the original beneficiary decides not to pursue further education. This ensures that the funds are used for educational purposes within the family. The Coverdell ESA is a powerful tool for education savings, and by understanding its fun facts and hidden benefits, you can make the most of this valuable resource.

How to Coverdell ESA Budget Planning

Planning a Coverdell ESA budget involves several steps. First, determine the total cost of education you want to cover. This includes tuition, fees, books, supplies, and room and board. Research the average cost of these expenses at the schools your child is interested in attending.

Next, estimate how much you can realistically contribute to the ESA each year. Consider your income, expenses, and other financial goals. Don't forget to factor in the annual contribution limit of $2,000 per beneficiary. Create a budget that includes regular contributions to your Coverdell ESA. Treat it as a non-negotiable expense, just like rent or utilities. Automate your contributions to make it easier to stick to your budget. Choose investment options that align with your risk tolerance and time horizon. If your child is young, you may want to consider a more aggressive investment strategy with a higher allocation to stocks. As your child gets closer to college age, you may want to shift to a more conservative approach with a higher allocation to bonds. Regularly review your budget and investment performance. Make adjustments as needed to ensure that you are on track to meet your savings goals. Consider consulting with a financial advisor. They can provide valuable guidance and support as you develop your Coverdell ESA budget planning strategy. By following these steps, you can create a solid plan that helps you achieve your education savings goals and secure your child's future.

What If Coverdell ESA Budget Planning

What if your child doesn't go to college? What happens to the money in the Coverdell ESA? Fortunately, there are several options. You can transfer the account to another eligible family member, such as a sibling or cousin. This allows you to use the funds for their educational expenses.

You can also use the funds for other qualified education expenses, such as vocational school or trade school. This can be a great option if your child is interested in pursuing a career that doesn't require a four-year college degree. If you don't have any other eligible beneficiaries, you can withdraw the funds, but you will have to pay taxes and a 10% penalty on the earnings. However, there are some exceptions to the penalty, such as if the beneficiary becomes disabled or if the funds are used for military service. Another option is to simply leave the money in the account. The Coverdell ESA can continue to grow tax-free, and you can use it for future educational expenses. Ultimately, the best option depends on your individual circumstances and goals. It's important to carefully consider your options and consult with a financial advisor before making any decisions. By understanding what happens if your child doesn't go to college, you can be prepared for any situation and make the most of your Coverdell ESA.

Listicle of Coverdell ESA Budget Planning

Here's a quick listicle to guide your Coverdell ESA budget planning:

1.Determine Your Savings Goals: Estimate the total cost of education you want to cover.

2.Create a Budget: Include regular contributions to your Coverdell ESA.

3.Automate Contributions: Set up automatic transfers from your bank account.

4.Choose Investments Wisely: Select options that align with your risk tolerance and time horizon.

5.Review Regularly: Adjust your budget and investment performance as needed.

6.Understand Qualified Expenses: Know what you can use the funds for without penalties.

7.Consider Alternatives: Explore options if your child doesn't go to college.

8.Seek Professional Advice: Consult with a financial advisor for personalized guidance.

9.Start Early: Begin saving as soon as possible to maximize growth.

10.Stay Informed: Keep up-to-date with any changes to the rules and regulations of Coverdell ESAs.

Question and Answer of Coverdell ESA Budget Planning

Q: What are the income limitations for contributing to a Coverdell ESA?

A: For 2023, you can contribute the full $2,000 if your modified adjusted gross income (MAGI) is less than $110,000 if single, or less than $220,000 if married filing jointly. Contributions are phased out for MAGI between $110,000 and $120,000 for single filers, and between $220,000 and $240,000 for married filing jointly. You cannot contribute if your MAGI is above these phase-out ranges.

Q: What happens if I contribute more than $2,000 to a Coverdell ESA in a year?

A: If you contribute more than the annual limit, you may be subject to a 6% excise tax on the excess contribution. It's important to stay within the contribution limits to avoid penalties.

Q: Can I use Coverdell ESA funds for computers or internet access?

A: Yes, computers and internet access can be considered qualified education expenses if they are primarily used by the beneficiary while enrolled at an eligible educational institution.

Q: What's the difference between a Coverdell ESA and a 529 plan?

A: A Coverdell ESA offers more investment flexibility and can be used for K-12 expenses, while 529 plans typically have higher contribution limits and may offer state tax benefits. The best choice depends on your individual circumstances and goals.

Conclusion of Coverdell ESA Budget Planning

A Coverdell ESA, when strategically implemented with thoughtful budget planning, offers a powerful tool for securing your child's educational future. By understanding the nuances of contribution limits, eligible expenses, investment options, and potential alternatives, you can make informed decisions and maximize the benefits of this valuable savings vehicle. Whether it's for tuition, books, or specialized equipment, a well-managed Coverdell ESA can provide significant financial support, paving the way for your child's academic success.

Post a Comment