Dormitory Expense Budget Planning: Campus Living Financial Guide

Are you gearing up for college life and the exciting, yet daunting, prospect of living in a dorm? The freedom is intoxicating, but the financial responsibilities can be a rude awakening. It's time to take control of your finances and make the most of your campus living experience!

Many students find themselves quickly overwhelmed by the costs associated with dorm life. From unexpected expenses like late-night pizza cravings and impromptu trips to the laundromat to the more significant costs of textbooks and school supplies, it's easy to see how a student budget can quickly spiral out of control. This can lead to unnecessary stress, impacting academic performance and overall well-being.

This guide is designed to equip you with the knowledge and tools necessary to create a realistic and effective dormitory expense budget. We'll explore practical strategies for managing your money, tracking your spending, and making informed financial decisions throughout your college years. Our aim is to help you navigate the financial challenges of campus living so you can focus on your studies and enjoy your college experience without the burden of financial worries.

This article provides a comprehensive guide to dormitory expense budgeting, covering everything from creating a budget and tracking expenses to identifying cost-saving measures and avoiding common financial pitfalls. We'll delve into essential topics like managing utilities, meal planning, entertainment budgeting, and emergency fund allocation. With practical tips, real-life examples, and helpful resources, you'll be well-equipped to navigate the financial landscape of campus living and achieve your financial goals.

Understanding Your Dormitory Expenses

The target of "Understanding Your Dormitory Expenses" is to help students identify and categorize all the potential costs associated with living in a dorm, enabling them to create a more accurate and comprehensive budget.

My freshman year, I significantly underestimated the cost of laundry. I thought, "How much could it really be?" Turns out, when you're doing multiple loads a week, those dollars add up fast! Then there were the late-night study snacks. Ramen wasn't cutting it, and those vending machine runs became a habit I hadn't accounted for. It was a wake-up call.

Dormitory expenses extend far beyond just rent and tuition. Think about utilities (if applicable), laundry, toiletries, school supplies, textbooks (which can be a HUGE expense), entertainment, food (beyond the meal plan), and transportation. It's essential to break down each category and estimate your monthly spending. For example, textbooks can be estimated by checking used book prices online or contacting upperclassmen. Don't forget those miscellaneous expenses – the occasional pizza night with friends, a trip to the campus bookstore for that essential school spirit item, or unexpected medical costs.

To effectively budget, start by listing all potential expenses. Then, research the average cost of each item or service on your campus. Talk to current students, check bulletin boards, and utilize online resources to get a realistic picture of the financial landscape. Finally, categorize each expense as either fixed (e.g., rent, tuition) or variable (e.g., food, entertainment) to help you prioritize and manage your spending effectively.

Creating a Realistic Budget

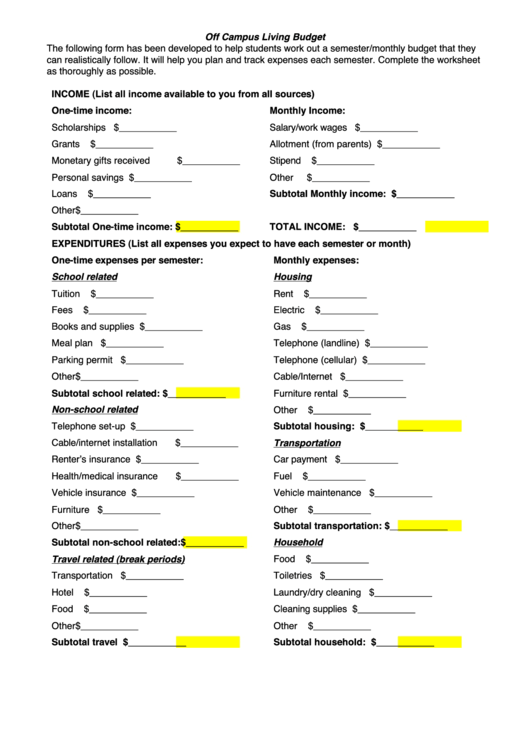

Creating a realistic budget for dormitory expenses involves carefully estimating income, categorizing expenses, and tracking spending habits to ensure financial stability and avoid overspending.

A dormitory expense budget is a comprehensive financial plan that outlines all anticipated expenses related to living in a dorm, including rent, utilities, food, transportation, school supplies, and entertainment. It helps students manage their finances effectively, prioritize spending, and avoid debt while pursuing their academic goals.

Creating a budget begins with understanding your income. This might include financial aid, scholarships, grants, part-time job earnings, and contributions from your family. Be honest about your income and avoid overestimating. Next, meticulously list all your expenses. Separate them into fixed costs, like rent and tuition, and variable costs, like food and entertainment. Estimate how much you'll spend on each category monthly. Several budgeting apps and templates are available online to help you with this process.

Once you've created your initial budget, track your spending religiously. Use a budgeting app, a spreadsheet, or even a simple notebook to record every expense. At the end of each week or month, compare your actual spending to your budgeted amounts. If you're consistently overspending in a particular category, identify areas where you can cut back. Maybe you can pack your lunch more often instead of eating out, or find free entertainment options on campus. Regularly review and adjust your budget as needed. As your circumstances change – for example, if you get a raise at your part-time job – update your budget to reflect your new financial situation. Remember, budgeting is not about restriction; it's about making informed choices that allow you to achieve your financial goals while enjoying your college experience. It’s about empowering yourself to take control of your money and making sure your money is working for you, not the other way around.

The History and Myths of Dormitory Expense Budgeting

The history and myths surrounding dormitory expense budgeting shed light on the evolution of financial planning for students and debunk common misconceptions about the costs of campus living.

Historically, budgeting for dormitory expenses wasn't as crucial as it is today. Tuition was often lower, and many students relied on family support or worked part-time jobs to cover their costs. However, as the cost of higher education has risen dramatically, budgeting has become an essential skill for managing finances while living in a dorm.

One common myth is that dormitory life is inherently cheaper than living off-campus. While dorms often include utilities and some meals, the overall cost can still be high, especially when factoring in mandatory meal plans and other fees. Another myth is that scholarships and financial aid will cover all expenses. While these resources are invaluable, they often don't cover everything, leaving students to bridge the gap with personal savings or loans.

A persistent myth is the "instant ramen diet" is a financially sound long-term solution. While ramen is cheap, relying solely on it is nutritionally inadequate and can lead to health issues. Smart budgeting involves finding a balance between affordable options and maintaining a healthy diet. Furthermore, the belief that budgeting is restrictive and takes the fun out of college life is a significant deterrent. However, an effective budget empowers students to make informed spending choices, ensuring they have enough money for both necessities and leisure activities.

The evolution of dormitory expense budgeting reflects the changing landscape of higher education. Debunking myths and providing accurate information empowers students to make informed financial decisions, contributing to their overall success and well-being.

Unveiling the Hidden Secrets of Dormitory Expense Budgeting

The hidden secrets of dormitory expense budgeting involve discovering unconventional cost-saving strategies and maximizing resources to reduce expenses while enhancing the overall college experience.

One often-overlooked secret is utilizing campus resources. Many universities offer free or low-cost services like tutoring, counseling, health clinics, and recreational facilities. These resources can save students money on expenses they would otherwise incur off-campus. Another secret is to take advantage of student discounts. Many businesses offer discounts to students with a valid ID, from clothing stores to movie theaters. Always ask if a student discount is available before making a purchase.

A hidden gem is buying used textbooks and selling them back after the semester ends. Textbooks can be a significant expense, but buying used books or renting them can save hundreds of dollars. Additionally, consider sharing textbooks with classmates or accessing digital versions when available. Another secret is to avoid impulse purchases. Before buying anything, ask yourself if you really need it or if it's just a want. Wait a day or two before making a purchase to see if you still feel the same way.

Finally, a key secret is to embrace frugality without sacrificing your quality of life. This means finding creative ways to save money, like cooking meals in your dorm room, participating in free campus activities, and taking advantage of free transportation options. By implementing these hidden secrets, students can reduce their dormitory expenses and enjoy a more financially secure college experience.

Recommendations for Effective Dormitory Expense Budgeting

Recommendations for effective dormitory expense budgeting include creating a detailed budget, tracking expenses meticulously, setting financial goals, and regularly reviewing and adjusting the budget to maintain financial stability.

I strongly recommend starting your budget well before you move into the dorm. This gives you time to research costs, compare options, and make informed decisions. Talk to current students or alumni to get realistic estimates of expenses specific to your campus.

Another recommendation is to set realistic financial goals. Do you want to save money for a spring break trip, pay off student loans early, or build an emergency fund? Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can motivate you to stick to your budget and make progress toward your financial aspirations.

I also recommend using budgeting apps or spreadsheets to track your expenses. These tools can help you visualize your spending habits and identify areas where you can cut back. Be consistent in recording every expense, no matter how small, to get an accurate picture of your financial situation.

Finally, review and adjust your budget regularly. Your expenses and income may change over time, so it's essential to update your budget accordingly. Make adjustments as needed to stay on track toward your financial goals. Effective dormitory expense budgeting is not a one-time task, but an ongoing process that requires discipline, commitment, and flexibility.

Practical Budgeting Strategies for Students

Practical budgeting strategies for students involve creating a detailed budget, tracking expenses, setting financial goals, and making informed spending decisions to maintain financial stability and achieve academic success.

One effective strategy is to create a zero-based budget. This means allocating every dollar of your income to a specific expense category, ensuring that your income minus your expenses equals zero. This approach forces you to prioritize your spending and avoid wasting money on unnecessary items.

Another strategy is to use the 50/30/20 rule. Allocate 50% of your income to essential needs like rent, food, and transportation, 30% to wants like entertainment and dining out, and 20% to savings and debt repayment. This rule provides a simple framework for balancing your spending and saving.

Utilizing envelope budgeting system is a strategy too. For variable expenses like food and entertainment, allocate a fixed amount of cash to separate envelopes each month. Once the money in an envelope is gone, you can't spend any more in that category until the next month. This system helps you control your spending and avoid overspending.

Remember to automate savings and debt repayment. Set up automatic transfers from your checking account to your savings account and loan accounts each month. This ensures that you're consistently saving money and paying down debt without having to think about it. Also, review your bank and credit card statements regularly to identify any errors or fraudulent charges. This can help you catch and resolve issues quickly, preventing financial losses.

Essential Tips for Dormitory Expense Budget Planning

Essential tips for dormitory expense budget planning include creating a detailed budget, tracking expenses, prioritizing spending, setting financial goals, and regularly reviewing and adjusting the budget to maintain financial stability.

My top tip is to prioritize your needs over your wants. Before making any purchase, ask yourself if it's something you truly need or just something you want. Differentiating between needs and wants can help you make more informed spending decisions and avoid impulse purchases.

Another essential tip is to avoid using credit cards unless you can pay off the balance in full each month. Credit card interest rates can be high, and carrying a balance can quickly lead to debt. If you do use a credit card, use it responsibly and pay off the balance on time.

I also recommend taking advantage of student discounts and free campus resources. Many businesses offer discounts to students, and universities often provide free services like tutoring, counseling, and recreational facilities. These resources can save you money and enhance your college experience.

Consider finding a part-time job or internship to supplement your income. Working part-time can help you cover your expenses and gain valuable work experience. Look for on-campus jobs or internships that align with your interests and academic goals.

Finally, be prepared for unexpected expenses. Set aside a small amount of money each month for emergencies. This will help you avoid going into debt when unexpected costs arise. Dormitory expense budget planning requires discipline, commitment, and flexibility. By following these essential tips, you can manage your finances effectively and enjoy a financially secure college experience.

Common Budgeting Mistakes to Avoid

Common budgeting mistakes to avoid include failing to track expenses, underestimating costs, overspending on non-essentials, and neglecting to set financial goals, which can lead to financial instability and stress.

One of the most common mistakes is failing to track expenses. Without knowing where your money is going, it's impossible to identify areas where you can cut back. Use a budgeting app, a spreadsheet, or even a simple notebook to record every expense.

Another mistake is underestimating costs. Many students underestimate the cost of textbooks, transportation, and entertainment. Research the average cost of each item or service on your campus and adjust your budget accordingly. Talk to current students or alumni to get realistic estimates.

Overspending on non-essentials is a common pitfall. It's easy to get caught up in the excitement of college life and spend too much money on dining out, entertainment, and shopping. Prioritize your needs over your wants and avoid impulse purchases.

Neglecting to set financial goals is another mistake. Without clear financial goals, it's difficult to stay motivated and disciplined with your budgeting. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your spending and saving decisions.

Ignoring unexpected expenses is a frequent blunder. Life is full of surprises, and unexpected expenses are bound to arise. Set aside a small amount of money each month for emergencies to avoid going into debt when these costs occur. Avoiding these common budgeting mistakes can help you manage your finances effectively and enjoy a financially secure college experience.

Fun Facts About Dormitory Expense Budget Planning

Fun facts about dormitory expense budget planning highlight the importance of financial literacy for college students and provide interesting insights into the costs and strategies associated with managing finances in a dorm setting.

Did you know that the average college student spends over $1,000 on textbooks each year? This highlights the importance of exploring alternative options like renting used books or accessing digital versions to save money. Another fun fact is that students who create and stick to a budget are more likely to graduate with less debt. This underscores the long-term benefits of effective financial planning.

It's also interesting to note that many universities offer free financial literacy workshops and counseling services to students. These resources can provide valuable guidance and support for managing finances while in college. Fun Fact: The most common "budget buster" for college students is eating out. Those frequent trips to restaurants and cafes can quickly add up, so it's essential to plan meals and cook in your dorm room whenever possible.

The first dormitories were built in medieval Europe as housing for students attending universities. These early dorms were often austere and lacked many of the amenities we take for granted today. Today's students now have to account for streaming services, electronics, and many other things that the earlier students didn't have to account for.

Dormitory expense budget planning can be challenging, but it's an essential skill for college students. By learning to manage your finances effectively, you can reduce stress, avoid debt, and achieve your academic and financial goals.

How to Create a Dormitory Expense Budget

Creating a dormitory expense budget involves carefully estimating income, categorizing expenses, and tracking spending habits to ensure financial stability and avoid overspending during your college years.

The first step is to estimate your income. This might include financial aid, scholarships, grants, part-time job earnings, and contributions from your family. Be realistic about your income and avoid overestimating.

Next, list all your expenses. Separate them into fixed costs, like rent and tuition, and variable costs, like food and entertainment. Estimate how much you'll spend on each category monthly. Use online resources to research average costs for specific items or services on your campus.

Then, track your spending. Use a budgeting app, a spreadsheet, or even a simple notebook to record every expense. Be consistent in tracking your spending, no matter how small, to get an accurate picture of your financial situation.

Compare your actual spending to your budgeted amounts. If you're consistently overspending in a particular category, identify areas where you can cut back. Make adjustments to your budget as needed to stay on track toward your financial goals.

Review and adjust your budget regularly. Your expenses and income may change over time, so it's essential to update your budget accordingly. Be flexible and willing to make adjustments as needed. Creating a dormitory expense budget is an ongoing process that requires discipline, commitment, and flexibility. By following these steps, you can manage your finances effectively and enjoy a financially secure college experience.

What If You Can't Stick to Your Dormitory Expense Budget?

If you can't stick to your dormitory expense budget, it's important to reassess your spending habits, identify areas where you can cut back, and seek resources or support to help you get back on track financially.

First, don't panic. Everyone overspends occasionally. The key is to identify the problem and take corrective action. Review your budget and compare it to your actual spending. Where are you consistently overspending?

Identify areas where you can cut back. Can you reduce your spending on entertainment, dining out, or shopping? Look for ways to save money without sacrificing your quality of life.

Consider finding additional sources of income. Can you work more hours at your part-time job or take on a side hustle? Increasing your income can help you cover your expenses and get back on track with your budget.

Seek financial assistance from your university. Many universities offer financial aid, grants, and scholarships to students who are struggling financially. Talk to a financial aid advisor to explore your options.

Talk to a financial counselor. Financial counselors can provide personalized guidance and support to help you manage your finances effectively. They can help you create a realistic budget, develop a debt repayment plan, and make informed financial decisions.

If you can't stick to your dormitory expense budget, it's important to take action quickly. Don't ignore the problem or hope it will go away on its own. By reassessing your spending habits, identifying areas where you can cut back, and seeking resources or support, you can get back on track financially and avoid long-term financial problems.

A Listicle: Top 5 Tips for Saving Money in a Dorm

Here's a listicle offering the top 5 tips for saving money in a dorm, providing practical advice to help students manage their expenses effectively and make the most of their college experience.

1.Cook Your Own Meals: Eating out can be expensive. Save money by cooking your own meals in your dorm room or in the communal kitchen. Plan your meals in advance and buy groceries in bulk to save even more money.

2.Take Advantage of Free Campus Activities: Many universities offer free events like concerts, movies, and sporting events. Take advantage of these activities to have fun without spending money.

3.Buy Used Textbooks: Textbooks can be a significant expense. Save money by buying used textbooks or renting them from the library.

4.Avoid Impulse Purchases: Before buying anything, ask yourself if you really need it or if it's just a want. Waiting a day or two before making a purchase can help you avoid impulse purchases.

5.Track Your Expenses: Use a budgeting app, a spreadsheet, or a simple notebook to record every expense. Tracking your expenses can help you identify areas where you can cut back and save money.

These five tips can help you save money while living in a dorm. By making smart choices and being mindful of your spending, you can manage your finances effectively and enjoy a financially secure college experience.

Question and Answer Section

Here are some common questions and answers about dormitory expense budget planning:

Question 1: What are the most common expenses students forget to budget for?

Answer: Many students forget to budget for expenses like laundry, toiletries, entertainment, and transportation. These expenses can add up quickly, so it's important to factor them into your budget.

Question 2: How often should I review my budget?

Answer: You should review your budget at least once a month, or more frequently if your expenses or income change. This will help you stay on track toward your financial goals.

Question 3: What are some ways to save money on textbooks?

Answer: You can save money on textbooks by buying used books, renting books from the library, or accessing digital versions.

Question 4: What should I do if I can't stick to my budget?

Answer: If you can't stick to your budget, reassess your spending habits, identify areas where you can cut back, and seek resources or support to help you get back on track financially.

Conclusion of Dormitory Expense Budget Planning: Campus Living Financial Guide

Budgeting for dormitory expenses is a crucial skill for college students. By creating a detailed budget, tracking expenses, setting financial goals, and making informed spending decisions, you can manage your finances effectively and enjoy a financially secure college experience. Remember to prioritize your needs over your wants, avoid impulse purchases, and take advantage of student discounts and free campus resources. If you encounter challenges, don't hesitate to seek guidance from financial counselors or utilize online tools. With dedication and planning, you can navigate the financial landscape of campus living and achieve your academic and financial aspirations.

Post a Comment