Free Budget Planning Spreadsheet Templates That Work

Feeling overwhelmed by your finances? You're not alone! Trying to keep track of income, expenses, and savings goals can feel like juggling a dozen balls at once. What if there was a way to simplify the process and gain better control of your money, without spending a dime?

So many of us struggle to manage our budgets effectively. Maybe you've tried budgeting apps that are too complex, or spreadsheets that feel like a data entry nightmare. You might be left wondering if there's a simple, straightforward solution that can actually help you understand where your money is going and make informed financial decisions.

That's where free budget planning spreadsheet templates come in! They offer a user-friendly way to track your income and expenses, identify areas where you can save money, and achieve your financial goals. This article will explore some of the best free templates available and how they can transform the way you manage your money.

This article explores the benefits of free budget planning spreadsheet templates, highlighting their accessibility and ease of use. We'll delve into various options, from simple templates for beginners to more advanced ones for detailed financial tracking. We'll cover topics like customizing templates, using formulas for calculations, and incorporating them into your overall financial planning strategy. Ultimately, these templates can empower you to take control of your finances and work towards a more secure future. Keywords: Budgeting, spreadsheets, financial planning, templates, free, money management, expenses, income, savings.

Unveiling the Power of Free Budgeting

My journey into budgeting wasn't exactly smooth sailing. I remember staring blankly at complex financial software, feeling more confused than ever about where my money was disappearing to. I even tried the "envelope method," which resulted in crumpled bills and a general sense of disorganization. It wasn't until I discovered the world of free budget planning spreadsheet templates that things started to click.

The beauty of these templates lies in their simplicity and customizability. You can find a template that perfectly suits your needs, whether you're a student tracking part-time earnings or a family managing household expenses. The act of manually entering your income and expenses forces you to become more aware of your spending habits. Suddenly, that daily coffee or impulsive online purchase becomes much more apparent. It's like shining a spotlight on your financial behavior, allowing you to make more conscious choices. The best templates often come pre-loaded with formulas that automatically calculate totals, subtotals, and even charts to visualize your spending patterns. They offer a clear and unbiased view of your financial situation, empowering you to make informed decisions about saving, investing, and debt repayment. These templates provide a fantastic starting point for anyone looking to gain control of their finances and work towards a more secure future. The freedom to experiment with different scenarios and adjust your budget as needed is invaluable. They also serve as a great tool for communicating financial goals with family members or partners. I know that without these templates, I would have continued to blindly navigate my finances, but now I am on the right track.

What Exactly Are Free Budget Planning Spreadsheet Templates?

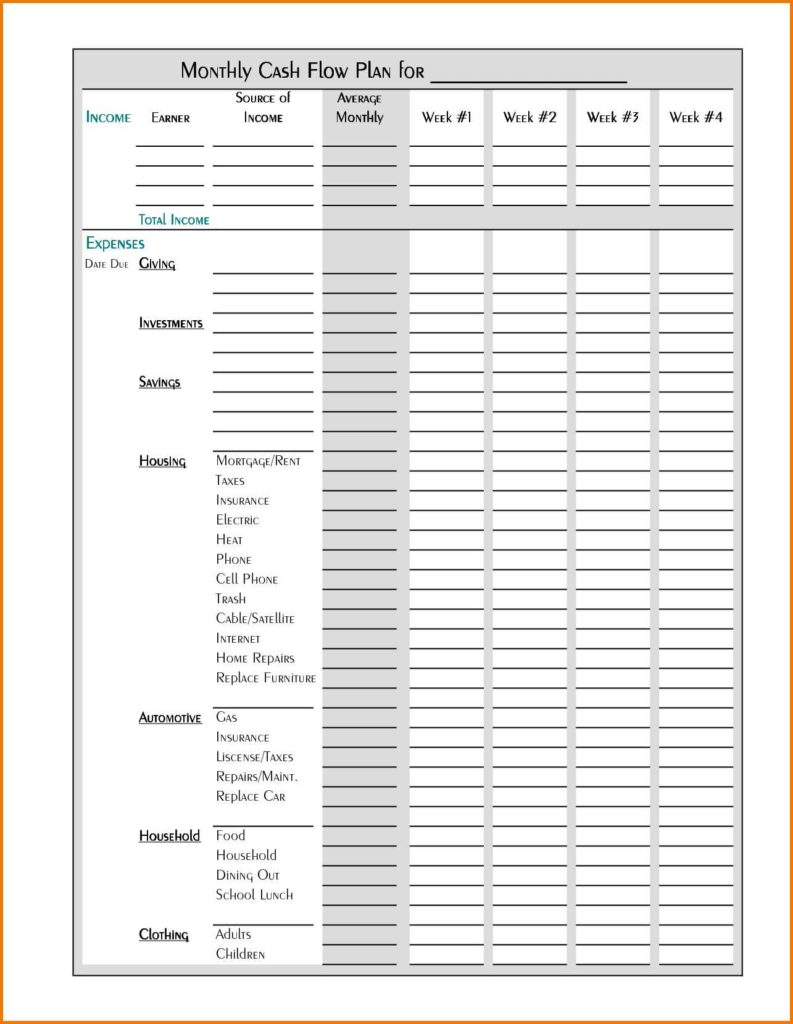

Think of free budget planning spreadsheet templates as pre-designed frameworks that help you organize your financial information in a clear and structured manner. These templates are typically created using software like Microsoft Excel, Google Sheets, or other spreadsheet programs. They provide pre-formatted columns and rows for entering your income, expenses, savings, and debt payments. They often include built-in formulas that automatically calculate totals, track spending trends, and generate charts and graphs for visual representation of your financial data.

The primary goal of these templates is to simplify the budgeting process and make it more accessible to everyone, regardless of their financial expertise. Instead of starting from scratch with a blank spreadsheet, you can simply download a free template and customize it to fit your specific needs. Most templates allow you to categorize your expenses into different categories, such as housing, transportation, food, entertainment, and utilities. This categorization helps you understand where your money is going and identify areas where you can potentially cut back on spending. Advanced templates may also include features like goal tracking, debt payoff calculators, and investment trackers. These tools can help you set financial goals, monitor your progress, and make informed decisions about your investments. Overall, free budget planning spreadsheet templates offer a convenient and effective way to manage your finances, track your progress, and achieve your financial goals. They are a valuable resource for anyone looking to gain control of their money and build a more secure financial future. They can be easily shared with family member and friends.

The History and Myths Surrounding Budgeting Spreadsheets

The concept of budgeting itself is ancient, dating back to early civilizations that tracked resources and planned for the future. However, the modern spreadsheet as we know it emerged in the late 20th century with the advent of personal computers. Visi Calc, released in 1979, is often credited as the first spreadsheet program and revolutionized the way businesses and individuals managed their finances. Prior to spreadsheets, budgeting was a manual and time-consuming process involving paper ledgers and calculators.

One common myth surrounding budgeting spreadsheets is that they are only for people who are struggling financially. In reality, budgeting is a valuable tool for anyone, regardless of their income level. It helps you understand your spending habits, identify areas where you can save money, and achieve your financial goals. Another myth is that spreadsheets are too complicated or time-consuming to use. While it's true that some templates can be complex, there are plenty of simple and user-friendly options available. Many free templates come pre-loaded with formulas and instructions, making it easy to get started. Furthermore, the time invested in creating and maintaining a budget spreadsheet is well worth it, as it can save you money and reduce financial stress in the long run. It's also a myth that budgeting is restrictive and takes away from the joy of spending. On the contrary, budgeting can actually empower you to spend more consciously and guilt-free. By tracking your expenses and setting financial goals, you can prioritize the things that are most important to you and make informed decisions about how to allocate your resources. Lastly, a popular myth is that budgeting spreadsheets are inflexible and can't adapt to changing circumstances. While some templates may be rigid, most spreadsheets are highly customizable and can be adjusted to accommodate your specific needs and financial situation. You can easily add or remove categories, change formulas, and adjust your budget as your income, expenses, and goals evolve. They empower to be in charge.

Unlocking the Hidden Secrets of Budget Planning Templates

One of the biggest hidden secrets of budget planning templates lies in their ability to reveal your unconscious spending habits. We often think we know where our money is going, but tracking every transaction can expose hidden expenses we weren't even aware of. That daily coffee run, the impulse purchases on online shopping sites, or the subscription services we rarely use can all add up to significant amounts over time.

Another secret is the power of customization. While many free templates offer a great starting point, the real magic happens when you tailor them to your specific needs and goals. You can add or remove categories, adjust formulas, and create custom reports to gain deeper insights into your financial data. Experiment with different scenarios and see how changes in your income or expenses would impact your overall financial situation. Don't be afraid to experiment and personalize your template to make it work for you. A third secret is the use of visual aids. Many spreadsheet programs allow you to create charts and graphs based on your budget data. These visuals can help you quickly identify trends, spot potential problems, and track your progress towards your financial goals. A simple pie chart showing your spending breakdown can be incredibly insightful, revealing where your money is going at a glance. Lastly, a well-maintained budget spreadsheet can serve as a powerful tool for negotiating with creditors or service providers. When you have a clear and accurate picture of your finances, you can confidently request lower interest rates, negotiate payment plans, or cancel unnecessary services. Many people don't realize the potential negotiating power that comes with having a well-documented budget. This can lead to financial success.

Recommendations for Choosing the Right Budget Template

Choosing the right budget template can feel overwhelming, especially with so many free options available. The key is to start by identifying your specific needs and goals. Are you a student tracking part-time earnings? A young professional managing student loan debt? Or a family planning for a major purchase like a house or a car?

Once you understand your needs, look for templates that offer the features and functionalities you require. If you're a beginner, opt for a simple and user-friendly template with basic categories and clear instructions. Avoid templates with too many bells and whistles, as they can be confusing and overwhelming. If you're more experienced with spreadsheets, you might prefer a more advanced template with features like goal tracking, debt payoff calculators, and investment trackers. Consider the software you're most comfortable using. If you're already familiar with Microsoft Excel, look for templates designed for Excel. If you prefer Google Sheets, there are plenty of free templates available that are specifically designed for Google's online spreadsheet program. Read reviews and testimonials from other users. This can give you valuable insights into the usability and effectiveness of different templates. A template that works well for one person may not be the best fit for another, so it's important to do your research and find one that aligns with your needs and preferences. Don't be afraid to try out a few different templates before settling on one. Most free templates are readily available for download, so you can experiment and see which one you like best. Choose a template that is easy to customize and adapt to your changing financial circumstances. Your budget will likely evolve over time, so it's important to select a template that can grow with you. A great way to do this is share them with your friends.

Navigating the Features of Popular Budget Templates

Many popular budget templates share common features like income tracking, expense categorization, and summary reports. However, some templates go above and beyond by offering advanced functionalities such as debt payoff calculators, investment trackers, and goal-setting tools. Exploring these features can significantly enhance your budgeting experience.

Debt payoff calculators, for example, can help you visualize different debt repayment strategies and determine the most efficient way to eliminate your debt. You can input your debt balances, interest rates, and monthly payments, and the calculator will generate a schedule showing how long it will take to pay off each debt and how much interest you will save. Investment trackers allow you to monitor the performance of your investments and track your progress towards your financial goals. You can input your investment holdings, purchase dates, and current values, and the tracker will calculate your returns and provide insights into your investment portfolio. Goal-setting tools can help you define your financial goals, create a plan to achieve them, and track your progress along the way. You can set goals for saving for a down payment on a house, paying off debt, or investing for retirement. The tool will then help you break down your goals into smaller, more manageable steps and track your progress over time. Some templates also offer integration with financial institutions, allowing you to automatically import your transaction data and avoid manual data entry. This can save you a significant amount of time and effort. However, be sure to research the security and privacy practices of any template that requires access to your financial information. Lastly, look for templates that offer mobile compatibility, allowing you to access and update your budget on the go. This can be particularly useful if you want to track your spending in real-time or make quick adjustments to your budget while you're out and about. Doing these things will help you in the long run.

Budgeting Tips That Will Boost Your Finances

Consistency is key to successful budgeting. Make it a habit to update your spreadsheet regularly, ideally on a daily or weekly basis. The more frequently you track your expenses, the more accurate and insightful your budget will be. This also keeps you mindful of your spending habits and helps you avoid overspending.

Be realistic about your income and expenses. Don't overestimate your income or underestimate your expenses, as this will create a false sense of security and lead to frustration. If you're unsure about certain expenses, err on the side of caution and overestimate them. Review your budget regularly and make adjustments as needed. Your financial situation is constantly evolving, so it's important to update your budget to reflect those changes. Adjust your income, expenses, and goals as necessary to stay on track. Categorize your expenses in detail. The more granular your expense categories, the more insights you'll gain into your spending habits. Instead of lumping everything into a generic "entertainment" category, break it down into "movies," "restaurants," "concerts," etc. Look for opportunities to automate your savings. Set up automatic transfers from your checking account to your savings account on a regular basis. This makes saving effortless and helps you build your savings balance without even thinking about it. Don't be afraid to seek help if you're struggling with budgeting. There are many free resources available online, including budgeting apps, websites, and online communities. You can also consult with a financial advisor for personalized guidance. Budgeting should be empowering, not stressful. If you find yourself feeling overwhelmed or discouraged, take a step back and re-evaluate your approach. Remember that budgeting is a journey, not a destination. With persistence and patience, you can master the art of budgeting and achieve your financial goals. It all starts with your attitude.

The Importance of Setting Financial Goals

Setting clear and achievable financial goals is crucial for successful budgeting. These goals provide direction and motivation, helping you stay focused and committed to your financial plan. Without goals, budgeting can feel aimless and demotivating.

Start by identifying your short-term, medium-term, and long-term financial goals. Short-term goals might include saving for a down payment on a car, paying off a credit card, or building an emergency fund. Medium-term goals could involve saving for a house, paying off student loans, or starting a business. Long-term goals might include saving for retirement, funding your children's education, or achieving financial independence. Make your goals specific, measurable, achievable, relevant, and time-bound (SMART). Instead of saying "I want to save more money," set a specific goal like "I want to save $500 per month for the next six months to build an emergency fund." Break down your goals into smaller, more manageable steps. This makes them less daunting and more achievable. For example, if your goal is to save $10,000 for a down payment on a house, break it down into monthly savings targets and track your progress along the way. Visualize your goals. Create a vision board or write down your goals in a journal. This helps you stay motivated and reminds you of what you're working towards. Review your goals regularly and make adjustments as needed. Your financial goals may change over time, so it's important to update them to reflect your current circumstances. Celebrate your achievements. When you reach a financial goal, reward yourself (within reason) to acknowledge your hard work and stay motivated to continue pursuing your financial aspirations. Make sure that they are in line with your values.

Fun Facts About Budget Planning Spreadsheets

Did you know that the first electronic spreadsheet program, Visi Calc, is credited with helping to popularize personal computers in the late 1970s and early 1980s? Before Visi Calc, financial calculations were done manually, which was time-consuming and prone to errors.

The term "spreadsheet" comes from the accounting world, where large sheets of paper were used to manually record financial data in columns and rows. Modern spreadsheet programs are essentially digital versions of these traditional paper spreadsheets. Microsoft Excel is the most widely used spreadsheet program in the world, with hundreds of millions of users worldwide. However, there are many other popular spreadsheet programs available, including Google Sheets, Apache Open Office Calc, and Libre Office Calc. Spreadsheet programs are used in a wide variety of industries, from finance and accounting to marketing and engineering. They are versatile tools that can be used for a wide range of tasks, from budgeting and financial planning to data analysis and project management. The formulas and functions available in spreadsheet programs can perform complex calculations and automate repetitive tasks. This saves time and reduces the risk of errors. Spreadsheet programs can be used to create charts and graphs that visually represent data. This makes it easier to identify trends, spot patterns, and communicate insights to others. Many spreadsheet programs offer collaboration features that allow multiple users to work on the same spreadsheet simultaneously. This can be particularly useful for teams working on projects together. The ability to easily import and export data between spreadsheet programs and other applications makes them valuable for data integration and analysis. Their value is immeasurable. They are a timeless tool.

How to Find the Perfect Budgeting Template for You

Finding the perfect budgeting template involves a bit of exploration. Start by searching online using keywords like "free budget spreadsheet template," "household budget template," or "personal finance spreadsheet." Numerous websites offer a variety of templates to download.

Explore template galleries offered by spreadsheet software providers like Microsoft and Google. These galleries often feature a wide range of templates designed for different budgeting needs. Check personal finance blogs and websites. Many bloggers and financial experts offer free budget templates as resources for their readers. Read reviews and testimonials from other users. This can give you valuable insights into the usability and effectiveness of different templates. Consider your specific budgeting needs and preferences. Do you need a simple template for tracking basic income and expenses? Or a more advanced template with features like goal tracking, debt payoff calculators, and investment trackers? Don't be afraid to try out a few different templates before settling on one. Most free templates are readily available for download, so you can experiment and see which one you like best. Choose a template that is easy to customize and adapt to your changing financial circumstances. Your budget will likely evolve over time, so it's important to select a template that can grow with you. Take a look at recommendations of professional advisors. These will provide a new aspect of budgeting. They can assist you to achieve your goals quicker.

What If I Can't Find a Template That Fits My Needs?

If you can't find a pre-made template that perfectly suits your needs, don't despair! The beauty of spreadsheet programs is their flexibility. You can easily create your own custom budget template from scratch. Start by outlining the categories you want to track. This might include income, expenses (broken down into various subcategories), savings, and debt payments.

Create columns for each category and rows for each time period (e.g., weekly, monthly). Use formulas to calculate totals, subtotals, and other relevant metrics. For example, you can use the SUM function to calculate your total income and expenses. You can also use formulas to calculate the difference between your income and expenses (your net income) and to track your progress towards your savings goals. Add charts and graphs to visualize your data. This can help you quickly identify trends and spot potential problems. Experiment with different layouts and designs until you find something that works for you. Don't be afraid to get creative and personalize your template to make it your own. Take advantage of online resources and tutorials. There are many free resources available online that can teach you how to use spreadsheet programs and create custom formulas. You can also find templates and examples that you can adapt to your own needs. Remember that creating a custom budget template takes time and effort, but the results are well worth it. A template that is specifically tailored to your needs will be much more effective than a generic pre-made template. The possibilities are endless and can give you the ultimate budgeting experience. Give it a try! You may be surprised.

A Listicle of Essential Features in Budgeting Templates

A well-designed budget template should include the following essential features: Clear and concise categories for income and expenses. This makes it easy to track your spending and identify areas where you can save money.

Automatic calculations for totals, subtotals, and net income. This saves time and reduces the risk of errors. Customizable categories that allow you to tailor the template to your specific needs. The ability to track your progress towards your financial goals. This helps you stay motivated and focused on your financial plan. Charts and graphs that visually represent your data. This makes it easier to identify trends and spot potential problems. Debt payoff calculators that help you visualize different debt repayment strategies and determine the most efficient way to eliminate your debt. Investment trackers that allow you to monitor the performance of your investments and track your progress towards your financial goals. Integration with financial institutions that allows you to automatically import your transaction data and avoid manual data entry. Mobile compatibility that allows you to access and update your budget on the go. Clear instructions and helpful tips that guide you through the budgeting process. A user-friendly interface that is easy to navigate and understand. A visually appealing design that makes budgeting more enjoyable. Regular updates and improvements that keep the template current and relevant. These features will help you immensely. Be sure to check them out when choosing a template. They are essential to your success.

Question and Answer About Budget Planning Spreadsheet Templates

Q: Are free budget planning spreadsheet templates really effective?

A: Yes! They provide a structured framework for tracking your finances, which can lead to increased awareness of spending habits and better financial control. The best part is, they don't cost a thing!

Q: What if I'm not good with spreadsheets?

A: No worries! Many templates are designed to be user-friendly and come with clear instructions. Start with a simple template and gradually explore more advanced features as you become more comfortable.

Q: Can I use these templates on my phone or tablet?

A: It depends on the template and the spreadsheet program you're using. Google Sheets templates, for example, can be accessed and edited on mobile devices through the Google Sheets app. Microsoft Excel also has mobile apps for viewing and editing spreadsheets.

Q: How often should I update my budget spreadsheet?

A: Ideally, you should update your budget spreadsheet regularly, at least once a week. This will help you stay on top of your spending and identify any potential problems early on.

Conclusion of Free Budget Planning Spreadsheet Templates

Free budget planning spreadsheet templates are a powerful tool for anyone looking to take control of their finances. They offer a simple, accessible, and customizable way to track income and expenses, identify areas for savings, and achieve financial goals. With a wealth of free options available online, there's a template out there to suit every need and skill level. Embrace the power of budgeting and start building a more secure financial future today!

Post a Comment