Military Deployment Money Management: Overseas Financial Planning

Imagine receiving deployment orders. Excitement mixes with apprehension, but have you considered the financial aspects of your upcoming adventure? Many service members focus on the operational aspects of deployment, often overlooking the critical need for sound financial planning.

Deployments can bring unexpected financial strain. From managing finances back home while you're away, to navigating foreign currencies and potential investment opportunities, the challenges can feel overwhelming. Failing to address these issues can lead to unnecessary stress and financial setbacks, impacting not only your well-being but also your family's security.

This guide aims to equip you with the knowledge and tools necessary to confidently manage your finances during a military deployment. We'll explore strategies for budgeting, saving, investing, and protecting your assets while serving overseas. Our goal is to empower you to make informed financial decisions and secure a brighter future for yourself and your loved ones.

This article covers essential financial strategies for military personnel deploying overseas. We'll delve into budgeting techniques suitable for deployment life, explore avenues for saving and investing wisely, discuss the importance of protecting your assets through insurance and legal preparedness, and highlight resources available to support your financial well-being. By mastering these key areas, you can navigate the financial landscape of deployment with confidence and achieve your long-term financial goals. Keywords: military deployment, financial planning, overseas, budgeting, saving, investing, insurance.

Understanding Deployment Pay and Benefits

The target of understanding deployment pay and benefits is to make sure that you're fully aware of the additional compensation you're entitled to while deployed. This knowledge is the foundation for making sound financial decisions and maximizing your savings potential.

I remember when I first deployed, I was completely lost when it came to understanding my Leave and Earnings Statement (LES). It was a jumble of acronyms and deductions that made no sense. It wasn't until a seasoned NCO took the time to explain the various entitlements – things like Hostile Fire Pay, Family Separation Allowance, and Combat Zone Tax Exclusion – that I realized how much extra money I was actually earning. This newfound understanding allowed me to create a realistic budget and set meaningful savings goals.

Deployment pay often includes numerous allowances and benefits beyond your regular base pay. Hostile Fire Pay/Imminent Danger Pay (HFP/IDP) compensates you for serving in areas where you face significant risks. Family Separation Allowance (FSA) helps offset the costs associated with being separated from your family. Combat Zone Tax Exclusion (CZTE) allows you to exclude certain income from federal taxes, significantly boosting your take-home pay. Understanding the specifics of these entitlements is crucial. Carefully review your LES each month and don't hesitate to ask your unit's finance office for clarification if you're unsure about any item. Accurate understanding of your income is paramount to effective financial planning during deployment.

Creating a Deployment Budget

Creating a deployment budget is about more than just tracking expenses; it's about establishing a roadmap for your financial success during your time overseas. It helps you prioritize your spending, identify areas where you can save, and ensure that you're making progress toward your financial goals.

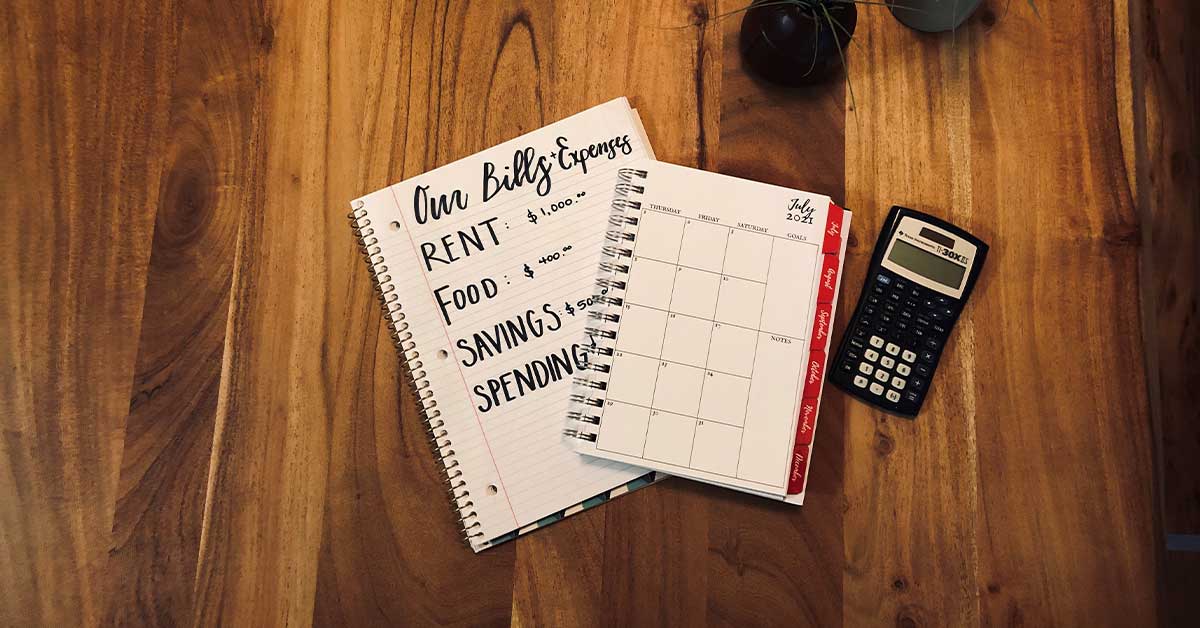

A deployment budget is a comprehensive plan that outlines your income and expenses during your deployment period. It should account for your regular military pay, deployment-related allowances (HFP/IDP, FSA, CZTE), and any additional income you may receive. On the expense side, it should include fixed costs like housing, utilities (if applicable), and insurance premiums, as well as variable expenses like food, entertainment, and transportation. By tracking your income and expenses, you can gain a clear understanding of your cash flow and identify opportunities to save more money. Tools like budgeting apps (Mint, YNAB), spreadsheets, or even a simple notebook can be incredibly helpful in managing your budget effectively. Regular review and adjustments are also vital to account for unforeseen expenses or changes in income. The point is to have a plan that actively reflects your finacial state and goals.

Budgeting will make you aware and make sure that you are taking control of your finance.

Investing During Deployment

Historically, investing during deployment wasn't always a straightforward option for service members. Access to information and investment opportunities was often limited, and many felt overwhelmed by the complexities of the financial markets. Myths about the risks of investing and the perception that it was only for the wealthy further discouraged participation.

While deployed, it's easy to think about spending all the extra money. The reality is, deployment offers a unique opportunity to accelerate your financial goals. Combat Zone Tax Exclusion (CZTE) can significantly increase your disposable income. Consider contributing more to your Thrift Savings Plan (TSP), especially if you're eligible for matching contributions. The TSP offers a variety of investment options, including lifecycle funds that automatically adjust your asset allocation as you approach retirement. Explore other investment options like individual retirement accounts (IRAs) or taxable brokerage accounts. Remember to diversify your portfolio to mitigate risk and consult with a qualified financial advisor to develop an investment strategy that aligns with your financial goals and risk tolerance. The key is to make informed decisions and take advantage of the financial benefits available to you during your deployment.

Protecting Your Assets

The hidden secret to financial stability during deployment isn't just about earning more money; it's about protecting what you already have. Failing to safeguard your assets can lead to significant financial losses and undermine your long-term financial security.

Protecting your assets involves several key steps. First, ensure you have adequate insurance coverage, including life insurance, health insurance, and property insurance. Review your policies to ensure they meet your current needs and that your beneficiaries are up to date. Create or update your will and power of attorney to ensure your affairs are in order in case of an emergency. Consider establishing a trust to manage your assets and provide for your loved ones. Take steps to protect yourself from identity theft and fraud, such as monitoring your credit reports and being cautious about sharing personal information online. Finally, seek legal and financial advice from qualified professionals to ensure you have a comprehensive asset protection plan in place. Protecting your assets is a cornerstone of responsible financial planning during deployment.

Financial Resources for Deployed Military

When it comes to financial planning during deployment, you're not alone. Numerous resources are available to help you navigate the complexities of managing your money overseas and make informed decisions.

The military offers several financial resources specifically designed to support deployed service members. Military One Source provides free financial counseling and educational resources on a wide range of topics, including budgeting, debt management, and investing. The Armed Forces Legal Assistance Program offers free legal advice on issues such as wills, powers of attorney, and consumer protection. The Thrift Savings Plan (TSP) provides a tax-advantaged retirement savings plan with low fees and a variety of investment options. Additionally, many military bases offer financial readiness programs and workshops to help service members develop sound financial habits. Take advantage of these resources to gain the knowledge and support you need to manage your finances effectively during deployment. Accessing these resources is a smart move that will help secure your financial future.

Budgeting Apps and Tools

Budgeting apps and tools are like having a personal financial assistant in your pocket. They can help you track your spending, identify areas where you can save, and stay on top of your financial goals.

Numerous budgeting apps are available, each with its own unique features and benefits. Mint is a popular free app that allows you to track your spending, create budgets, and set financial goals. YNAB (You Need a Budget) is a subscription-based app that emphasizes proactive budgeting and helps you allocate every dollar to a specific purpose. Personal Capital offers a free financial dashboard that allows you to track your net worth, investments, and spending. In addition to apps, spreadsheets can be a powerful tool for budgeting. You can create your own spreadsheet using software like Microsoft Excel or Google Sheets, or download a pre-made template online. Choose the budgeting method that works best for you and commit to tracking your income and expenses regularly. Consistency is key to successful budgeting during deployment.

Tips for Saving Money Overseas

Saving money overseas can be a challenge, but with a little planning and discipline, it's definitely achievable. The key is to be mindful of your spending habits and take advantage of the opportunities available to you.

One of the best ways to save money overseas is to take advantage of the tax benefits available to deployed service members. The Combat Zone Tax Exclusion (CZTE) can significantly increase your disposable income, allowing you to save more money. Another tip is to minimize your spending on non-essential items like entertainment and dining out. Instead, consider cooking your own meals and taking advantage of free recreational activities offered on base. Shop around for the best deals on goods and services, and be wary of scams and predatory lending practices. Finally, set up automatic transfers from your checking account to your savings account to ensure that you're consistently saving money. These simple tips can help you save a significant amount of money during your deployment.

Managing Currency Exchange Rates

Understanding and managing currency exchange rates is crucial for service members deployed overseas. Fluctuations in exchange rates can significantly impact your spending power and the value of your savings.

The first step in managing currency exchange rates is to understand how they work. Exchange rates are constantly changing based on supply and demand, economic conditions, and other factors. You can track exchange rates online using websites like Google Finance or XE.com. When exchanging currency, be sure to shop around for the best rates. Banks, credit unions, and exchange bureaus all offer different rates, so it's important to compare before making a transaction. Avoid exchanging currency at airports or tourist traps, as they typically offer the worst rates. Consider using a credit card or debit card that doesn't charge foreign transaction fees, as these fees can quickly add up. Finally, be aware of the risks of currency speculation and avoid trying to time the market. Managing currency exchange rates effectively can help you save money and protect your financial interests during your deployment.

Fun Facts About Military Finances

Did you know that the military has its own unique financial language? Terms like "LES," "BAH," and "BAS" are commonplace, but can be confusing to those unfamiliar with military jargon. Understanding these terms is essential for managing your finances effectively.

Here's another fun fact: service members are eligible for a wide range of financial benefits, including tax breaks, savings programs, and loan assistance programs. The Combat Zone Tax Exclusion (CZTE) allows you to exclude certain income from federal taxes, significantly increasing your take-home pay. The Thrift Savings Plan (TSP) provides a tax-advantaged retirement savings plan with low fees and a variety of investment options. The Servicemembers Civil Relief Act (SCRA) provides legal protections to service members on active duty, including protection from eviction, foreclosure, and repossession. Taking advantage of these financial benefits can help you achieve your financial goals and secure your future. The US military has a long history of providing comprehensive financial support to its members. These fun facts highlight the unique aspects of military finances and the importance of understanding them.

How to Avoid Debt During Deployment

Avoiding debt during deployment is crucial for maintaining financial stability and achieving your long-term financial goals. While the additional income from deployment pay can be tempting to spend, it's important to prioritize debt reduction and avoid accumulating new debt.

One of the best ways to avoid debt during deployment is to create a budget and stick to it. Identify your essential expenses and prioritize paying them on time. Avoid impulse purchases and be wary of scams and predatory lending practices. If you have existing debt, such as credit card debt or student loans, consider using your deployment pay to pay it down aggressively. The faster you pay off your debt, the less interest you'll pay over time. Another strategy is to avoid taking out new loans during deployment, unless absolutely necessary. Consider consolidating your debt into a lower-interest loan or balance transfer credit card. Finally, seek financial counseling from a qualified professional to help you develop a debt management plan. Avoiding debt during deployment is a key step toward achieving financial freedom.

What If I Have Financial Trouble?

If you encounter financial trouble during deployment, it's important to take action immediately. Ignoring the problem will only make it worse and could lead to serious consequences.

The first step is to assess the situation and determine the extent of the problem. Are you struggling to pay your bills? Are you behind on your debt payments? Are you facing foreclosure or eviction? Once you understand the problem, you can start to develop a plan to address it. Contact your creditors and explain your situation. Many creditors are willing to work with service members who are experiencing financial hardship. Consider seeking financial counseling from a qualified professional. Military One Source and the Armed Forces Legal Assistance Program offer free financial counseling and legal assistance to service members. If you're facing foreclosure or eviction, seek legal assistance immediately. The Servicemembers Civil Relief Act (SCRA) provides legal protections to service members on active duty. Don't be afraid to ask for help. Numerous resources are available to support you during times of financial difficulty.

Top 5 Financial Mistakes to Avoid During Deployment

Here are five common financial mistakes to avoid during deployment:

- Failing to create a budget: Without a budget, it's easy to overspend and lose track of your money.

- Neglecting to save and invest: Deployment offers a unique opportunity to save and invest for your future. Don't miss out on this opportunity.

- Ignoring debt: Debt can quickly spiral out of control if you don't manage it effectively.

- Falling victim to scams: Be wary of scams and predatory lending practices that target deployed service members.

- Failing to seek financial advice: Don't be afraid to ask for help from a qualified financial professional. Avoiding these common mistakes can help you maintain financial stability and achieve your long-term financial goals. Take the time to plan.

Question and Answer

Here are some frequently asked questions about military deployment money management and overseas financial planning:

Q: What is the Combat Zone Tax Exclusion (CZTE)?

A: The CZTE allows service members serving in designated combat zones to exclude certain income from federal taxes, significantly increasing their take-home pay.

Q: What is the Thrift Savings Plan (TSP)?

A: The TSP is a tax-advantaged retirement savings plan available to federal employees, including military personnel. It offers low fees and a variety of investment options.

Q: What is the Servicemembers Civil Relief Act (SCRA)?

A: The SCRA provides legal protections to service members on active duty, including protection from eviction, foreclosure, and repossession.

Q: Where can I find free financial counseling?

A: Military One Source and the Armed Forces Legal Assistance Program offer free financial counseling and legal assistance to service members.

Conclusion of Military Deployment Money Management: Overseas Financial Planning

Navigating the financial landscape of a military deployment requires careful planning and proactive management. By understanding your deployment pay and benefits, creating a budget, saving and investing wisely, protecting your assets, and utilizing available resources, you can secure your financial well-being during your time overseas. Remember to avoid common financial mistakes, seek help when needed, and stay informed about the unique financial challenges and opportunities that deployment presents. With the right knowledge and strategies, you can not only survive financially during deployment but also thrive and achieve your long-term financial goals.

Post a Comment