Refinancing Money Management: Loan Restructure Financial Planning

Feeling weighed down by debt? Are your monthly payments a constant source of stress? What if there was a way to untangle your financial obligations and breathe a little easier? There is! Let's explore how refinancing and loan restructuring can be powerful tools for managing your money and building a brighter financial future.

Many of us find ourselves juggling multiple loans, each with different interest rates and due dates. This can lead to missed payments, accumulating interest, and a general feeling of being overwhelmed. Keeping track of everything becomes a monumental task, and the dream of financial freedom seems further and further away.

This article aims to demystify the concepts of refinancing and loan restructuring. We'll explore how these strategies can help you consolidate debt, lower your interest rates, and simplify your monthly payments. Ultimately, the goal is to empower you to take control of your finances and create a more manageable and sustainable debt repayment plan. Refinancing and loan restructuring offer the opportunity to streamline your financial obligations, potentially saving you money and reducing stress.

In essence, we'll delve into the world of debt management through strategic refinancing and loan restructuring. We'll uncover how these techniques can simplify your financial life, potentially saving you money through lower interest rates and more manageable payment schedules. This guide is your roadmap to navigating the complexities of debt and building a stronger financial foundation. Whether you're struggling with student loans, credit card debt, or a mortgage, understanding these options can be the key to unlocking financial peace of mind. The main keywords we will explore are refinancing, loan restructure, and financial planning.

Understanding Your Financial Landscape

I remember a time when I was fresh out of college, burdened with student loans, a car payment, and a few maxed-out credit cards. It felt like I was drowning in debt. Every month was a struggle to make ends meet, and the stress was constant. I started researching ways to consolidate my debt and that's when I first learned about refinancing and loan restructuring. It seemed daunting at first, but the potential benefits were too significant to ignore. I started by gathering all my loan information – interest rates, monthly payments, and outstanding balances. It was a bit of a wake-up call to see the total amount I owed. But with that information in hand, I started exploring my options.

Understanding your current financial situation is the first step towards effective refinancing and loan restructuring. This involves taking a close look at your debts, income, and expenses. Start by listing all your outstanding loans, including the interest rates, monthly payments, and remaining balances. Calculate your debt-to-income ratio (DTI), which is the percentage of your gross monthly income that goes towards debt payments. A high DTI can indicate that you're overextended and may struggle to meet your financial obligations. Next, assess your credit score. A good credit score can significantly improve your chances of getting approved for refinancing at a lower interest rate. Finally, create a budget to track your income and expenses. This will help you identify areas where you can cut back and free up more money for debt repayment. With a clear understanding of your financial landscape, you'll be better equipped to make informed decisions about refinancing and loan restructuring.

What is Refinancing and Loan Restructuring?

Refinancing and loan restructuring are strategies used to alter the terms of an existing loan, typically to achieve a more favorable outcome. Refinancing involves replacing an existing loan with a new loan, ideally with a lower interest rate or better terms. This can be done with various types of loans, including mortgages, auto loans, and student loans. The goal is to reduce your monthly payments, lower your overall interest costs, or shorten the loan term.

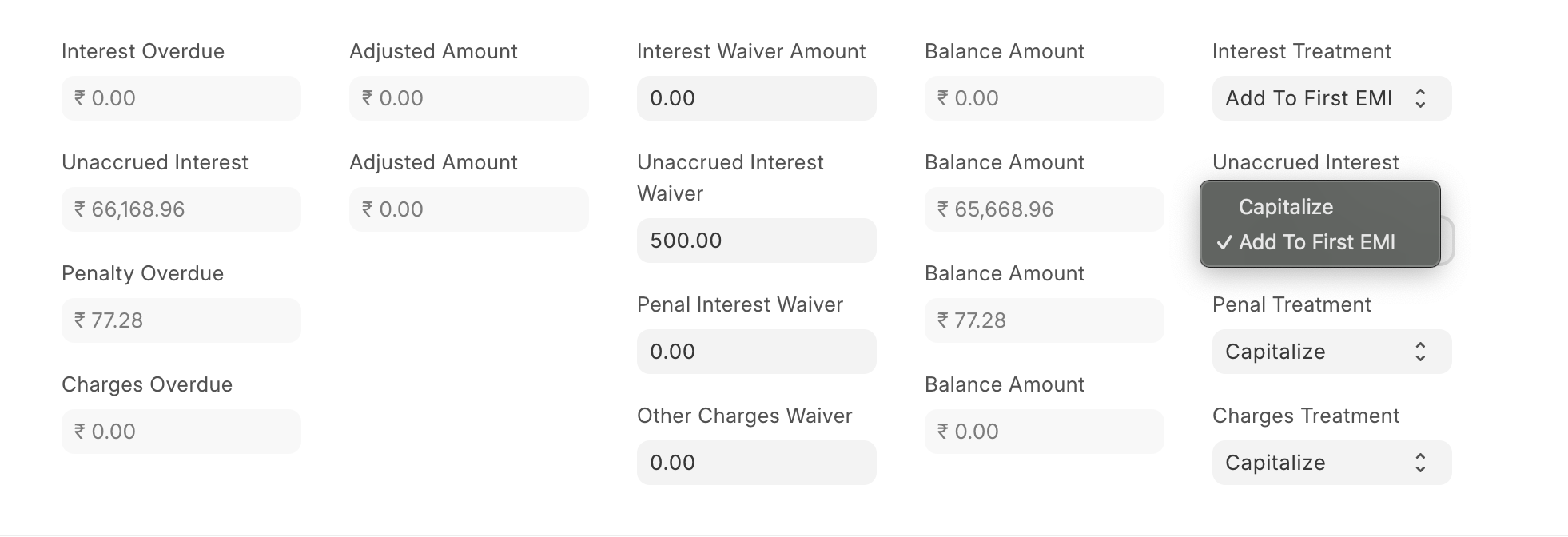

Loan restructuring, on the other hand, involves negotiating with your lender to modify the terms of your existing loan. This might include lowering the interest rate, extending the loan term, or even temporarily suspending payments. Loan restructuring is often an option for borrowers who are facing financial hardship and are at risk of default. Both refinancing and loan restructuring can be powerful tools for managing debt, but it's essential to understand the pros and cons of each option before making a decision. Consider factors such as closing costs, potential prepayment penalties, and the impact on your credit score. By carefully evaluating your options, you can choose the strategy that best aligns with your financial goals and circumstances.

The History and Myths of Refinancing

The concept of refinancing has been around for centuries, evolving alongside the financial landscape. In its early forms, refinancing was primarily used by businesses to manage their debts and invest in new opportunities. As financial markets developed, refinancing became more accessible to individuals, particularly with the rise of mortgages and consumer loans. Today, it's a widespread practice, used by millions of people to manage their debt and improve their financial well-being.

However, several myths surround refinancing. One common misconception is that refinancing is always a good idea. While it can be beneficial in many cases, it's not a one-size-fits-all solution. It's crucial to carefully evaluate the costs and benefits before making a decision. Another myth is that you need perfect credit to refinance. While a good credit score can help you secure a lower interest rate, it's still possible to refinance with less-than-perfect credit. You may need to shop around and compare offers from different lenders, but options are available. Finally, some people believe that refinancing is a complicated and time-consuming process. While it does require some effort and research, it doesn't have to be overwhelming. By understanding the process and seeking professional guidance when needed, you can navigate refinancing with confidence. Debunking these myths can empower you to make informed decisions about your financial future.

The Hidden Secrets of Refinancing

One of the hidden secrets of refinancing is the power of negotiation. Don't be afraid to negotiate with lenders to get the best possible terms. Research interest rates and offers from different lenders and use that information to leverage a better deal. Another secret is to consider the long-term impact of refinancing. While a lower monthly payment may seem appealing, it's essential to calculate the total interest you'll pay over the life of the loan. A longer loan term may result in lower monthly payments, but you could end up paying more interest in the long run.

Additionally, explore government programs and incentives that may be available to you. Some government agencies offer assistance with refinancing, particularly for student loans and mortgages. Another hidden secret is the importance of timing. Interest rates fluctuate over time, so it's crucial to monitor the market and refinance when rates are favorable. Be patient and wait for the right opportunity to lock in a low rate. Finally, don't overlook the potential tax benefits of refinancing. In some cases, you may be able to deduct the interest you pay on refinanced loans, which can help reduce your overall tax burden. Uncovering these hidden secrets can help you maximize the benefits of refinancing and achieve your financial goals.

Recommendations for Refinancing

Before refinancing, it's recommended to assess your financial goals. Are you primarily looking to lower your monthly payments, reduce your overall interest costs, or shorten your loan term? Knowing your goals will help you determine the best refinancing strategy. It's also recommended to shop around and compare offers from multiple lenders. Don't settle for the first offer you receive. Get quotes from different banks, credit unions, and online lenders to find the most competitive rates and terms.

Another recommendation is to carefully review the fine print before signing any agreements. Pay attention to fees, penalties, and other terms and conditions. Make sure you understand the total cost of refinancing, including any closing costs or prepayment penalties. It's also recommended to seek professional advice from a financial advisor. A financial advisor can help you assess your situation, evaluate your options, and make informed decisions about refinancing. They can also provide guidance on managing your debt and achieving your financial goals. Finally, remember that refinancing is not a one-time solution. It's essential to continue managing your debt responsibly and making timely payments to maintain a good credit score and avoid future financial problems. By following these recommendations, you can increase your chances of successful refinancing.

Refinancing and Your Credit Score

Refinancing can have both positive and negative impacts on your credit score. Applying for a new loan to refinance can initially cause a slight dip in your credit score due to the hard inquiry. However, if you manage the refinanced loan well, it can improve your credit score over time. Making timely payments on your loans is crucial for building a positive credit history. Refinancing can simplify your payments by consolidating multiple debts into a single loan, making it easier to manage and avoid missed payments.

A lower interest rate from refinancing can also free up cash flow, allowing you to pay down other debts and improve your credit utilization ratio. Credit utilization is the amount of credit you're using compared to your total available credit. A lower credit utilization ratio is generally viewed favorably by credit bureaus. In contrast, failing to make timely payments on your refinanced loan can negatively impact your credit score. Missed payments can lead to late fees, increased interest rates, and damage to your credit report. Therefore, it's crucial to budget carefully and ensure you can comfortably afford the monthly payments on your refinanced loan. Keep in mind that the impact of refinancing on your credit score can vary depending on your individual circumstances and credit history. It's essential to monitor your credit score regularly and take steps to maintain a healthy credit profile.

Tips for Successful Loan Restructuring

Successful loan restructuring requires careful planning and communication with your lender. Start by gathering all your financial documents, including your income statements, bank statements, and loan agreements. This will help you assess your financial situation and present a clear case to your lender. Contact your lender and explain your financial hardship. Be honest and transparent about your challenges and why you're seeking loan restructuring. Your lender may be more willing to work with you if they understand your situation.

Explore different restructuring options, such as lowering the interest rate, extending the loan term, or temporarily suspending payments. Ask your lender about the potential impact of each option on your credit score and overall cost of the loan. Be prepared to negotiate with your lender. They may not agree to your initial proposal, but you can work together to find a solution that works for both parties. Get any agreement in writing. This will protect you in case of future disputes. Finally, remember that loan restructuring is not a long-term solution. It's essential to address the underlying causes of your financial hardship and develop a plan for getting back on track. Consider seeking guidance from a financial advisor to help you manage your finances and avoid future financial problems. By following these tips, you can increase your chances of successful loan restructuring and avoid default.

Understanding Loan Forgiveness Programs

Loan forgiveness programs offer a path to debt relief for borrowers who meet specific criteria. These programs are typically offered by government agencies or non-profit organizations and are designed to assist individuals in certain professions or those facing financial hardship. One common type of loan forgiveness program is public service loan forgiveness (PSLF), which is available to borrowers who work in qualifying public service jobs, such as teaching, nursing, or government service. To qualify for PSLF, borrowers must make 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Another type of loan forgiveness program is income-driven repayment (IDR) forgiveness, which is available to borrowers who enroll in an IDR plan and make payments for a certain period. After the specified repayment period, any remaining balance on the loan is forgiven. The repayment period varies depending on the IDR plan. Certain professions, such as teachers and healthcare workers, may also be eligible for loan forgiveness programs offered by their employers or professional organizations. These programs often provide assistance with loan repayment in exchange for a commitment to work in a specific location or field. To determine if you're eligible for a loan forgiveness program, research the requirements and application process for each program. You may need to provide documentation to verify your eligibility. It's essential to understand the terms and conditions of the program before enrolling, as some programs may have tax implications or other requirements.

Fun Facts About Refinancing

Did you know that the most common reason people refinance their mortgages is to lower their interest rates? A small decrease in interest rate can save you thousands of dollars over the life of the loan. Another fun fact is that refinancing can be used to shorten the loan term. By refinancing to a shorter loan term, you can pay off your debt faster and save on interest. Refinancing can also be used to tap into your home equity. If you have equity in your home, you may be able to refinance and take out cash for home improvements, debt consolidation, or other expenses.

However, it's important to use this option wisely and avoid overextending yourself. One interesting fact is that interest rates on refinanced loans can vary significantly depending on your credit score. A good credit score can help you secure a lower interest rate and save money. Another fun fact is that refinancing can be a good option even if interest rates have slightly increased. By consolidating debt or shortening your loan term, you can still benefit from refinancing. Finally, did you know that you can refinance your mortgage multiple times? As long as it makes financial sense, you can refinance your mortgage as many times as you want. Keep in mind that refinancing involves costs and fees, so it's essential to carefully evaluate the pros and cons before making a decision.

How to Refinance Your Mortgage

Refinancing your mortgage involves several steps. First, assess your financial goals. Are you looking to lower your interest rate, shorten your loan term, or tap into your home equity? Knowing your goals will help you determine the best refinancing strategy. Next, check your credit score. A good credit score can help you secure a lower interest rate. You can obtain a free copy of your credit report from each of the major credit bureaus.

Then, shop around and compare offers from multiple lenders. Get quotes from different banks, credit unions, and online lenders. Pay attention to interest rates, fees, and other terms and conditions. Complete the application process. You'll need to provide documentation such as your income statements, bank statements, and tax returns. Undergo an appraisal. The lender will order an appraisal to determine the current value of your home. Close on the new loan. Once your application is approved, you'll attend a closing and sign the final documents. Be sure to carefully review all the documents before signing. Finally, manage your new loan responsibly. Make timely payments and avoid accumulating new debt. By following these steps, you can successfully refinance your mortgage and achieve your financial goals.

What if Refinancing Doesn't Work?

If refinancing doesn't work, don't despair. There are other options available to manage your debt. One option is to explore debt management plans (DMPs) offered by credit counseling agencies. A DMP can help you consolidate your debt and negotiate lower interest rates with your creditors. Another option is to consider debt settlement. This involves negotiating with your creditors to pay a lump sum that is less than the full amount you owe. However, debt settlement can have a negative impact on your credit score, so it's essential to weigh the pros and cons carefully.

Another option is to explore bankruptcy. Bankruptcy can provide debt relief, but it also has significant long-term consequences. Consider consulting with a bankruptcy attorney to understand your options. You can also try to increase your income and reduce your expenses. This will help you free up more money for debt repayment. Look for opportunities to earn extra income through a side hustle or part-time job. Cut back on non-essential expenses and create a budget to track your spending. Finally, remember to prioritize your debt repayment. Focus on paying down high-interest debt first, such as credit card debt. By exploring these alternative options, you can find a solution that works for your financial situation.

Listicle: 5 Benefits of Loan Restructuring

Here are 5 benefits of loan restructuring that might make you consider it:

- Lower Monthly Payments: One of the primary benefits of loan restructuring is the potential to lower your monthly payments, which can make your debt more manageable and free up cash flow.

- Reduced Interest Rates: Loan restructuring may involve negotiating a lower interest rate with your lender, which can save you money over the life of the loan.

- Consolidated Debt: Loan restructuring can help you consolidate multiple debts into a single loan, simplifying your finances and making it easier to track your payments.

- Avoid Default: Loan restructuring can help you avoid default if you're struggling to make your payments. By modifying the terms of your loan, you can make it more affordable and stay on track.

- Improved Credit Score: Loan restructuring can help you improve your credit score by avoiding missed payments and maintaining a positive payment history.

Question and Answer

Q: What is the difference between refinancing and loan restructuring?

A: Refinancing involves replacing an existing loan with a new loan, while loan restructuring involves modifying the terms of an existing loan.

Q: What are the benefits of refinancing?

A: Refinancing can lower your interest rate, shorten your loan term, and consolidate your debt.

Q: What are the benefits of loan restructuring?

A: Loan restructuring can lower your monthly payments, reduce your interest rate, and help you avoid default.

Q: How does refinancing affect my credit score?

A: Refinancing can initially cause a slight dip in your credit score, but it can improve your credit score over time if you manage the refinanced loan well.

Conclusion of Refinancing Money Management: Loan Restructure Financial Planning

Refinancing and loan restructuring are powerful tools for managing debt and improving your financial well-being. By understanding the concepts, exploring your options, and seeking professional guidance when needed, you can take control of your finances and achieve your financial goals. Remember to carefully evaluate the costs and benefits of each option and make informed decisions that align with your individual circumstances.

Post a Comment