Stock Investor Money Management: Equity Investment Financial Guide

Ever felt like your stock investments are more of a rollercoaster than a smooth ride to financial freedom? You're not alone. Many investors find navigating the stock market daunting, with its ups and downs constantly testing their resolve. What if there was a way to gain more control, manage risk effectively, and ultimately increase your chances of reaching your financial goals through smart investing?

The world of stock investing can often feel overwhelming. Juggling the need to research companies, understand market trends, and avoid costly mistakes while simultaneously trying to reach your financial goals can feel like an impossible balancing act. The consequences of poor planning can lead to significant losses and delayed financial independence.

This guide aims to provide a comprehensive overview of stock investor money management, focusing on equity investments. We'll explore strategies for building a well-diversified portfolio, managing risk effectively, understanding key financial metrics, and ultimately making informed investment decisions that align with your individual financial goals.

This article explores equity investments and guides you through the essentials of stock investor money management, covering topics such as portfolio diversification, risk assessment, understanding financial ratios, and developing a sound investment strategy. Mastering these concepts can empower you to navigate the stock market with confidence and work towards your financial objectives.

Understanding Your Risk Tolerance

Before diving into the specifics of stock selection and portfolio construction, it's crucial to understand your personal risk tolerance. Risk tolerance refers to your ability and willingness to withstand potential losses in your investments. This isn't just about how much money you have; it's also about your emotional comfort level with market volatility.

I remember when I first started investing, I jumped headfirst into a high-growth tech stock that everyone was talking about. I hadn't really considered my risk tolerance; I was just caught up in the hype. When the stock inevitably took a tumble, I panicked and sold at a loss. It was a painful lesson, but it taught me the importance of aligning my investments with my risk profile. Now, I always start by asking myself: "How would I feel if this investment lost 20%, 30%, or even 50% of its value?" If the thought keeps me up at night, it's probably not the right investment for me.

Determining your risk tolerance involves considering factors such as your age, financial goals, time horizon, and personality. Younger investors with longer time horizons generally have a higher risk tolerance, as they have more time to recover from potential losses. Conversely, older investors approaching retirement may prefer a more conservative approach to protect their capital. Your financial goals also play a significant role. If you're saving for a down payment on a house in the next few years, you'll likely want to avoid high-risk investments. Understanding your comfort level with volatility is equally important. Some people are naturally more risk-averse than others. Be honest with yourself about your emotional response to market fluctuations. There are many risk tolerance questionnaires available online that can provide a starting point for assessing your individual profile. Remember, investing should be a strategic and calculated process, not an emotional rollercoaster.

What is Equity Investment?

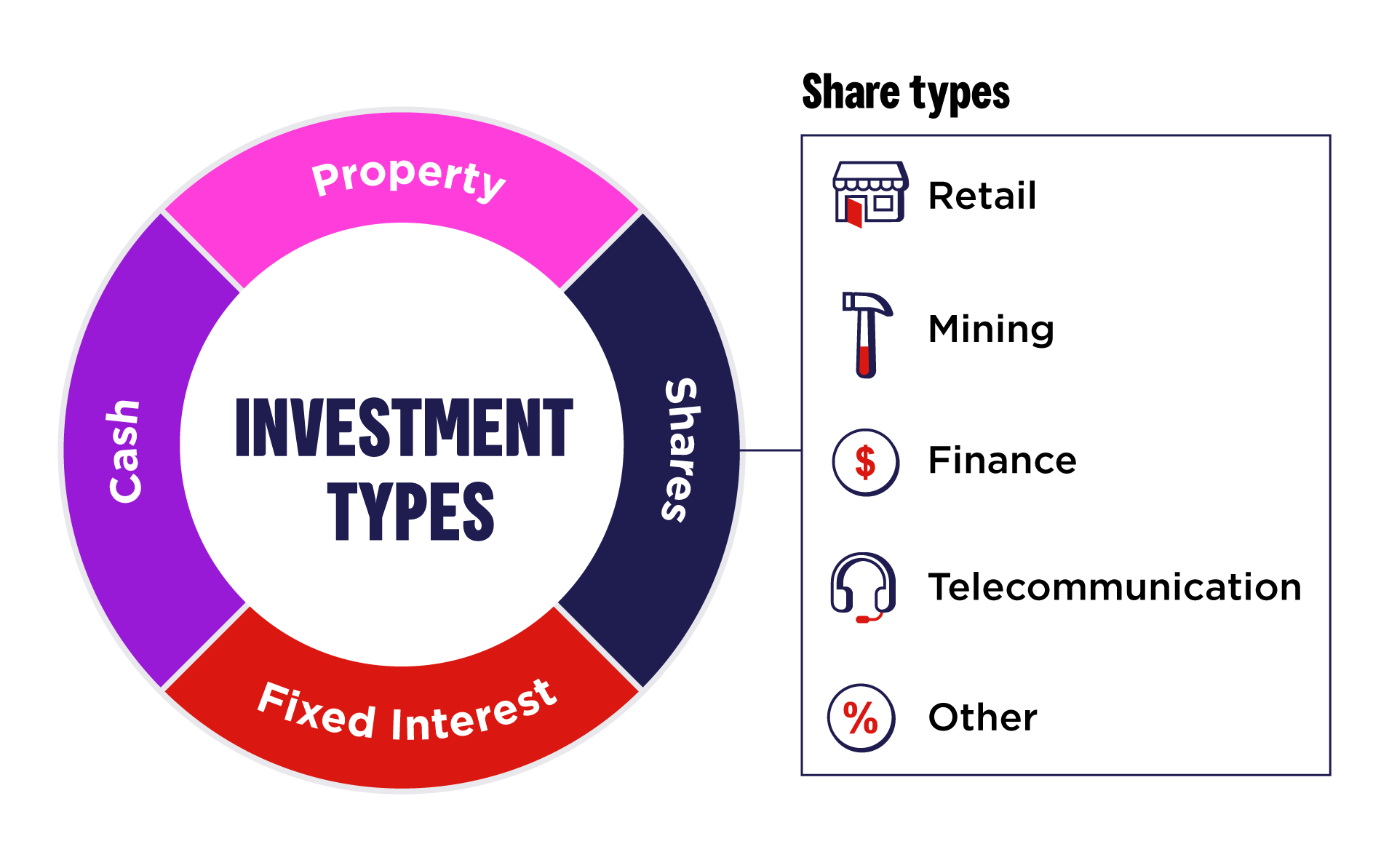

Equity investment refers to purchasing ownership stakes in companies, typically through buying shares of stock. When you buy stock, you become a shareholder and have a claim on a portion of the company's assets and earnings. This contrasts with debt investments, such as bonds, where you are essentially lending money to a company or government.

Equity investments offer the potential for higher returns than debt investments, but they also come with a higher level of risk. The value of a stock can fluctuate significantly based on factors such as company performance, economic conditions, and investor sentiment. However, over the long term, equities have historically outperformed other asset classes. Equity investments can take many forms, including common stock, preferred stock, and equity mutual funds. Common stock gives shareholders voting rights in the company, while preferred stock typically does not. Equity mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks. There are also Exchange Traded Funds (ETFs) that track a specific index or sector, giving instant diversification and are also classified as equity investment. Before making any equity investment, it's important to research the company and understand its business model, financial performance, and competitive landscape. Consider the financial implications carefully.

History and Myths of Equity Investment

The history of equity investment dates back centuries, with the first modern stock exchange established in Amsterdam in the early 17th century. The Dutch East India Company was the first company to issue publicly traded shares, allowing investors to participate in its lucrative trading voyages. Since then, stock markets have evolved significantly, becoming more accessible to individual investors and playing a crucial role in capital formation for businesses.

One common myth about equity investment is that it's only for the wealthy. While it's true that some investments require substantial capital, there are many ways to start investing with a relatively small amount of money. Another myth is that you need to be a financial expert to succeed in the stock market. While financial knowledge is certainly beneficial, it's not a prerequisite for investing. Many successful investors rely on a combination of fundamental research, technical analysis, and common sense. The myth of "get rich quick" also permeates the stock market, leading many investors to chase unrealistic returns and take on excessive risk. Equity investment is a long-term game that requires patience, discipline, and a well-defined investment strategy. Another common myth is that past performance is indicative of future results. While analyzing historical data can provide valuable insights, it's important to remember that the stock market is constantly evolving. The Dot-com bubble is a good example of how markets can defy conventional logic. Relying solely on past performance can lead to poor investment decisions. Successful equity investment requires continuous learning and adapting to changing market conditions.

Hidden Secrets of Equity Investment

While there's no magic formula for guaranteed success in equity investment, there are certain "hidden secrets" that can significantly improve your odds. One is understanding the power of compounding. Compounding refers to the ability of your investments to generate earnings, which then generate further earnings. Over time, this can lead to exponential growth. Another hidden secret is the importance of diversification. Diversifying your portfolio across different asset classes, sectors, and geographic regions can reduce your overall risk. Don't put all your eggs in one basket.

Furthermore, it is important to be disciplined and avoid emotional decision-making. The stock market can be volatile, and it's easy to get caught up in the hype or panic selling during downturns. However, successful investors remain calm and stick to their long-term investment strategy. Understanding financial statements is another crucial hidden secret. Being able to analyze a company's balance sheet, income statement, and cash flow statement can provide valuable insights into its financial health and potential for growth. Ignoring the "noise" and focusing on the fundamentals is key. Many investors get distracted by daily market news and short-term fluctuations. However, it's important to focus on the long-term prospects of the companies you invest in. Finally, consider taxes when making investment decisions. Certain investment strategies can be more tax-efficient than others. Seek professional advice if you're unsure about the tax implications of your investments. The more you understand these "hidden secrets," the better equipped you'll be to navigate the complexities of the stock market.

Recommendations for Equity Investment

Before recommending specific stocks or investment strategies, it's important to emphasize that everyone's financial situation is unique. Therefore, any recommendations should be tailored to your individual risk tolerance, financial goals, and time horizon. With that said, here are some general recommendations for equity investment:

Consider investing in a low-cost, diversified ETF. ETFs provide instant diversification and can be a cost-effective way to gain exposure to a broad market index, such as the S&P 500. Another recommendation is to focus on long-term investing. Avoid trying to time the market or make short-term trades. Instead, develop a long-term investment strategy and stick to it, regardless of market fluctuations. Regularly rebalance your portfolio to maintain your desired asset allocation. Over time, some investments will outperform others, which can skew your portfolio's asset allocation. Rebalancing involves selling some of your winning investments and buying more of your lagging investments to bring your portfolio back into balance. Invest in companies you understand. Don't invest in companies simply because they're popular or someone recommended them. Instead, take the time to research the company, understand its business model, and assess its financial performance. Consider consulting with a financial advisor. A financial advisor can help you assess your risk tolerance, develop a personalized investment strategy, and provide ongoing guidance. Finally, continue to learn and adapt. The stock market is constantly evolving, so it's important to stay informed and adapt your investment strategy as needed.

Choosing the Right Stocks

Selecting individual stocks can be challenging, but it can also be rewarding if done correctly. Start by defining your investment criteria. What are you looking for in a company? Are you focused on growth, value, or income? Growth stocks are companies that are expected to grow their earnings at a faster rate than the market average. Value stocks are companies that are trading at a discount to their intrinsic value. Income stocks are companies that pay a high dividend yield.

Once you've defined your investment criteria, you can start researching companies that meet your criteria. Analyze their financial statements. Look at their revenue growth, profitability, debt levels, and cash flow. Compare their performance to their competitors. Read industry reports and analyst opinions. Don't rely solely on financial data. Consider qualitative factors such as the company's management team, competitive advantages, and industry trends. Attend investor conferences or listen to earnings calls. This can provide valuable insights into the company's strategy and outlook. Be patient and selective. Don't feel pressured to invest in every stock that catches your eye. Wait for opportunities that align with your investment criteria and offer a favorable risk-reward ratio. Manage your risk by diversifying your stock holdings across different sectors and industries. Don't put all your eggs in one basket. Finally, monitor your investments regularly. Track the performance of your stocks and make adjustments as needed. Be prepared to sell stocks that no longer meet your investment criteria or that have reached your target price. Remember, investing in individual stocks involves risk, so be sure to do your research and understand the potential downsides before investing.

Tips for Stock Investor Money Management

Effective money management is crucial for successful stock investing. One essential tip is to set clear financial goals. What are you trying to achieve with your investments? Are you saving for retirement, a down payment on a house, or your children's education? Having clear goals will help you stay focused and make informed investment decisions. Another key tip is to create a budget and track your expenses. Knowing where your money is going will help you identify areas where you can save and invest more.

Automate your investments. Set up automatic transfers from your checking account to your investment account each month. This will help you stay consistent with your savings and avoid the temptation to spend the money elsewhere. Avoid emotional decision-making. The stock market can be volatile, and it's easy to get caught up in the hype or panic selling during downturns. Instead, stick to your long-term investment strategy and avoid making impulsive decisions based on emotions. Review your portfolio regularly. At least once a year, review your portfolio to ensure that it still aligns with your financial goals and risk tolerance. Make adjustments as needed. Don't be afraid to seek professional advice. A financial advisor can provide valuable guidance and help you make informed investment decisions. Finally, stay disciplined and patient. Investing is a long-term game, and it takes time to see results. Don't get discouraged by short-term market fluctuations. Stick to your plan and stay focused on your long-term goals.

Understanding Financial Ratios

Financial ratios are powerful tools for analyzing a company's financial performance and assessing its investment potential. They provide insights into a company's profitability, liquidity, solvency, and efficiency. Some key financial ratios include:

Price-to-Earnings (P/E) Ratio: This ratio compares a company's stock price to its earnings per share. It indicates how much investors are willing to pay for each dollar of earnings. A high P/E ratio may suggest that a stock is overvalued, while a low P/E ratio may suggest that it's undervalued. Price-to-Book (P/B) Ratio: This ratio compares a company's stock price to its book value per share. It indicates how much investors are willing to pay for each dollar of net assets. A low P/B ratio may suggest that a stock is undervalued. Debt-to-Equity (D/E) Ratio: This ratio measures a company's financial leverage by comparing its total debt to its shareholders' equity. A high D/E ratio may indicate that a company is heavily indebted and faces a higher risk of financial distress. Return on Equity (ROE): This ratio measures a company's profitability by dividing its net income by its shareholders' equity. It indicates how efficiently a company is using its equity to generate profits. A high ROE is generally considered favorable. Gross Profit Margin: This ratio measures a company's profitability by dividing its gross profit by its revenue. It indicates how efficiently a company is managing its production costs. Analyzing these and other financial ratios can help you make informed investment decisions and identify companies with strong financial fundamentals. Comparing these ratios to those of competitors and industry averages can provide valuable context.

Fun Facts of this Stock Investor Money Management

Did you know that Warren Buffett, one of the most successful investors of all time, started investing at the age of 11? Or that the stock market has historically delivered an average annual return of around 10% over the long term? These are just a few fun facts about the world of stock investing.

Here's another interesting fact: The term "stock market crash" is often associated with the Black Monday crash of 1987, when the Dow Jones Industrial Average plummeted by over 22% in a single day. However, many other significant market crashes have occurred throughout history, including the Wall Street Crash of 1929, which triggered the Great Depression. Another fun fact is that the New York Stock Exchange (NYSE) is located on Wall Street in New York City. It's the world's largest stock exchange by market capitalization. Did you know that the ticker symbol for Apple is AAPL? Or that the term "bull market" refers to a period of rising stock prices, while a "bear market" refers to a period of declining stock prices? The longest bull market in history lasted from 2009 to 2020, fueled by economic growth and low interest rates. Finally, investing in the stock market can be a great way to grow your wealth over time, but it's important to do your research and understand the risks involved.

How to Invest in Equity

Investing in equity is easier than ever, thanks to the proliferation of online brokerage accounts and investment apps. The first step is to open an account with a reputable brokerage firm. Compare fees, trading platforms, and research resources before making a decision. Once you've opened an account, you'll need to fund it by transferring money from your bank account.

Next, decide which types of equity investments you want to make. You can buy individual stocks, ETFs, or mutual funds. If you're new to investing, ETFs or mutual funds may be a good starting point, as they offer instant diversification. If you choose to invest in individual stocks, be sure to do your research and understand the company's business model, financial performance, and competitive landscape. When you're ready to make a trade, you'll need to enter the ticker symbol for the stock, ETF, or mutual fund you want to buy, as well as the number of shares you want to purchase. You'll also need to choose between a market order and a limit order. A market order instructs the broker to buy the shares at the current market price, while a limit order allows you to specify the price you're willing to pay. Finally, monitor your investments regularly and make adjustments as needed. Rebalance your portfolio periodically to maintain your desired asset allocation. Remember, investing in equity involves risk, so be sure to invest only what you can afford to lose.

What if I Lost Money?

Losing money in the stock market is an inevitable part of investing. Even the most successful investors experience periods of losses. However, it's important to learn from your mistakes and avoid repeating them in the future. The first thing to do is to analyze why you lost money. Was it due to poor stock selection, market volatility, or emotional decision-making?

Once you've identified the reasons for your losses, you can take steps to prevent them from happening again. If you lost money due to poor stock selection, consider refining your research process and focusing on companies with strong financial fundamentals. If you lost money due to market volatility, consider diversifying your portfolio and investing in less volatile assets. If you lost money due to emotional decision-making, consider developing a more disciplined investment strategy and avoiding impulsive trades. It's also important to remember that investing is a long-term game. Don't get discouraged by short-term losses. Stick to your plan and stay focused on your long-term goals. Consider dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This can help you reduce your risk and avoid trying to time the market. Finally, seek professional advice if you're struggling to manage your losses. A financial advisor can help you develop a strategy for recovering your losses and achieving your financial goals.

Listicle of Stock Investor Money Management

Here's a quick list of key takeaways for successful stock investor money management:

1. Understand Your Risk Tolerance: Assess your ability and willingness to withstand potential losses.

- Define Clear Financial Goals: Set specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Diversify Your Portfolio: Spread your investments across different asset classes, sectors, and geographic regions.

- Invest for the Long Term: Avoid trying to time the market or make short-term trades.

- Rebalance Your Portfolio Regularly: Maintain your desired asset allocation.

- Research Companies Thoroughly: Analyze their financial statements, business model, and competitive landscape.

- Avoid Emotional Decision-Making: Stick to your long-term investment strategy.

- Manage Your Expenses: Create a budget and track your spending.

- Automate Your Investments: Set up automatic transfers to your investment account.

- Seek Professional Advice: Consider consulting with a financial advisor.

Question and Answer

Q: How much money do I need to start investing in stocks?

A: You can start investing with as little as a few dollars, thanks to fractional shares offered by many online brokerages.

Q: What is diversification and why is it important?

A: Diversification involves spreading your investments across different asset classes, sectors, and geographic regions to reduce risk.

Q: How often should I rebalance my portfolio?

A: It's generally recommended to rebalance your portfolio at least once a year, or more frequently if your asset allocation deviates significantly from your target.

Q: What are some common mistakes that stock investors make?

A: Common mistakes include emotional decision-making, failing to diversify, trying to time the market, and not doing enough research.

Conclusion of Stock Investor Money Management: Equity Investment Financial Guide

Mastering stock investor money management and understanding equity investments are essential for achieving your long-term financial goals. By understanding your risk tolerance, diversifying your portfolio, researching companies thoroughly, and avoiding emotional decision-making, you can increase your chances of success in the stock market. Remember, investing is a long-term journey, and it requires patience, discipline, and a commitment to continuous learning.

Post a Comment